-

Afrikaans

Afrikaans -

Albanian

Albanian -

Amharic

Amharic -

Arabic

Arabic -

Armenian

Armenian -

Azerbaijani

Azerbaijani -

Basque

Basque -

Belarusian

Belarusian -

Bengali

Bengali -

Bosnian

Bosnian -

Bulgarian

Bulgarian -

Catalan

Catalan -

Cebuano

Cebuano -

China

China -

Corsican

Corsican -

Croatian

Croatian -

Czech

Czech -

Danish

Danish -

Dutch

Dutch -

English

English -

Esperanto

Esperanto -

Estonian

Estonian -

Finnish

Finnish -

French

French -

Frisian

Frisian -

Galician

Galician -

Georgian

Georgian -

German

German -

Greek

Greek -

Gujarati

Gujarati -

Haitian Creole

Haitian Creole -

hausa

hausa -

hawaiian

hawaiian -

Hebrew

Hebrew -

Hindi

Hindi -

Miao

Miao -

Hungarian

Hungarian -

Icelandic

Icelandic -

igbo

igbo -

Indonesian

Indonesian -

irish

irish -

Italian

Italian -

Japanese

Japanese -

Javanese

Javanese -

Kannada

Kannada -

kazakh

kazakh -

Khmer

Khmer -

Rwandese

Rwandese -

Korean

Korean -

Kurdish

Kurdish -

Kyrgyz

Kyrgyz -

Lao

Lao -

Latin

Latin -

Latvian

Latvian -

Lithuanian

Lithuanian -

Luxembourgish

Luxembourgish -

Macedonian

Macedonian -

Malgashi

Malgashi -

Malay

Malay -

Malayalam

Malayalam -

Maltese

Maltese -

Maori

Maori -

Marathi

Marathi -

Mongolian

Mongolian -

Myanmar

Myanmar -

Nepali

Nepali -

Norwegian

Norwegian -

Norwegian

Norwegian -

Occitan

Occitan -

Pashto

Pashto -

Persian

Persian -

Polish

Polish -

Portuguese

Portuguese -

Punjabi

Punjabi -

Romanian

Romanian -

Russian

Russian -

Samoan

Samoan -

Scottish Gaelic

Scottish Gaelic -

Serbian

Serbian -

Sesotho

Sesotho -

Shona

Shona -

Sindhi

Sindhi -

Sinhala

Sinhala -

Slovak

Slovak -

Slovenian

Slovenian -

Somali

Somali -

Spanish

Spanish -

Sundanese

Sundanese -

Swahili

Swahili -

Swedish

Swedish -

Tagalog

Tagalog -

Tajik

Tajik -

Tamil

Tamil -

Tatar

Tatar -

Telugu

Telugu -

Thai

Thai -

Turkish

Turkish -

Turkmen

Turkmen -

Ukrainian

Ukrainian -

Urdu

Urdu -

Uighur

Uighur -

Uzbek

Uzbek -

Vietnamese

Vietnamese -

Welsh

Welsh -

Bantu

Bantu -

Yiddish

Yiddish -

Yoruba

Yoruba -

Zulu

Zulu

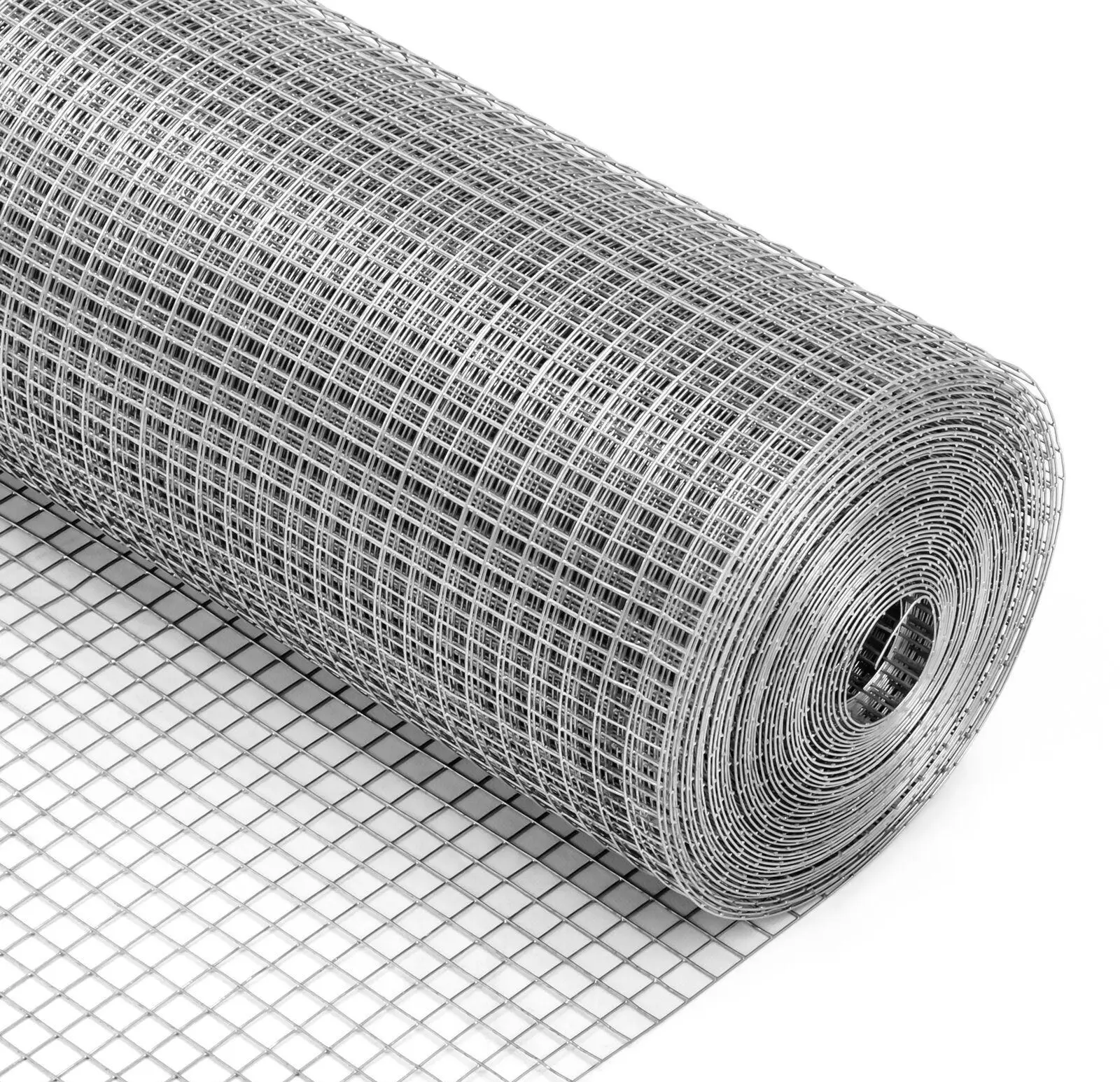

Affordable GI Weld Mesh Price Durable & Bulk Deals

- Market Dynamics Impacting GI Weld Mesh Pricing

- Technical Advantages of Galvanized Weld Mesh

- Leading Manufacturer Comparison Tables

- Customization Factors Affecting Final Costs

- Installation Cost Considerations

- Industry-Specific Application Scenarios

- Strategies for Weld Mesh Fence Price Optimization

(gi weld mesh price)

Understanding GI Weld Mesh Price Determinants

Current market volatility significantly impacts GI weld mesh pricing, with Q3 2023 seeing 18-22% fluctuations globally. Steel coil prices, constituting 55-60% of material costs, drove bulk pricing variations. Transportation expenses added 12-15% to overall costs, particularly affecting international orders. Regional tariffs between 7-15% further altered price competitiveness, creating distinct cost environments across markets. Production technology advancements reduced manufacturing waste by 37%, partially offsetting raw material inflation.

Technical Advantages in Wire Mesh Manufacturing

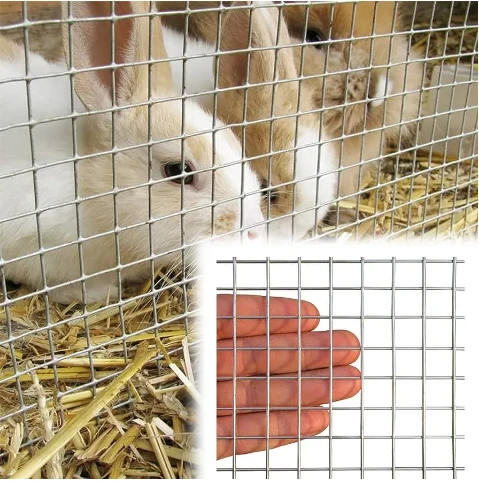

Modern weld mesh production employs continuous hot-dip galvanization, achieving zinc coatings of 80-100 g/m² for corrosion protection exceeding 25 years. High-frequency welding techniques increase production speeds by 40% compared to traditional methods while maintaining consistent 200 N/mm² tensile strength. Mesh openings maintain ±0.3mm dimensional accuracy even at production speeds of 60 meters/minute. Advanced coating verification systems using XRF technology ensure zinc thickness consistency across 99.8% of surfaces, significantly extending product lifespans in harsh environments.

Manufacturer Pricing and Specification Comparison

| Manufacturer | Wire Gauge Range | Zinc Coating | Panel Dimensions | Pricing/Ton (USD) | Lead Time |

|---|---|---|---|---|---|

| GlobalMesh Solutions | 3-8mm | 90g/m² | 2.4m x 25m rolls | $720-$880 | 14 days |

| SteelGuard Industries | 4-10mm | 120g/m² | Custom up to 3m | $850-$1,150 | 21 days |

| FortressWire Inc | 2.5-6mm | 75g/m² | 1.8m x 30m rolls | $680-$790 | 10 days |

Independent testing reveals significant durability differences, with heavier zinc coatings lasting 18% longer in salt spray tests. Premium manufacturers typically provide 15-year warranties versus standard 7-year policies. Production capacity directly affects discount structures, with mills exceeding 50,000 tons/year offering 8-12% bulk reductions.

Customization Pricing Variables

Specialized configurations increase GI weld mesh price by 15-40% over standard products. Rectangular patterns demand 25% more welding time than standard square configurations. Post-galvanization modifications add $45-65/ton due to secondary processing. Custom heights between 1-6m require specialized loom adjustments, increasing setup costs by 18% per unique specification. Protective edge treatments for cut ends add 7-10% to material costs but eliminate field maintenance. Non-standard wire diameters outside 3-6mm range require mill retooling, extending production timeframes by 3-5 working days.

Installation Cost Considerations

Labor constitutes 45-55% of total fencing project expenses. Experienced installation teams complete projects 25% faster than general contractors, significantly reducing on-site costs. Soil preparation expenses vary dramatically, with rock substrates increasing installation time by 40%. Automated tensioning systems reduce panel installation time to 18 minutes per 2.4m section versus 32 minutes for manual methods. Geographic location impacts crew costs by up to 60%, with urban projects averaging $32/meter versus rural areas at $20/meter. Post-installation treatments extend fence life by 7-10 years, reducing lifecycle expenses.

Industry-Specific Application Scenarios

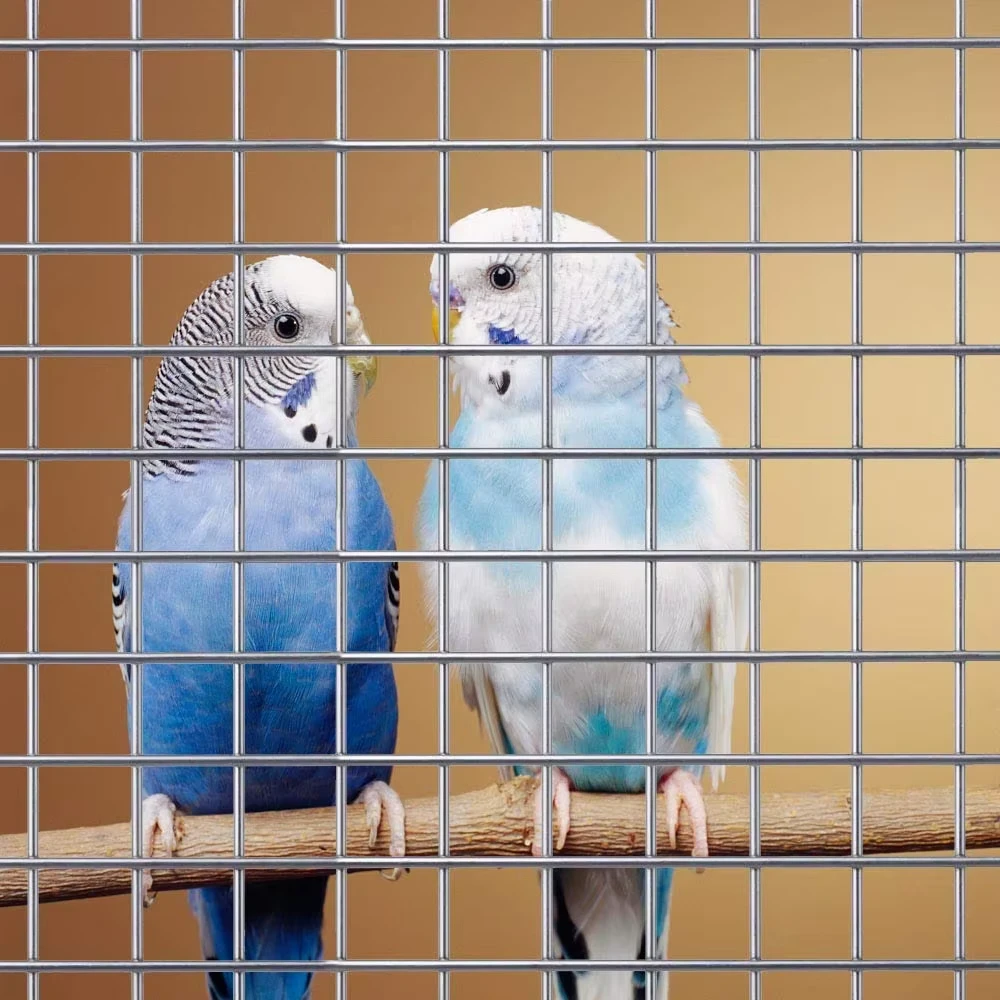

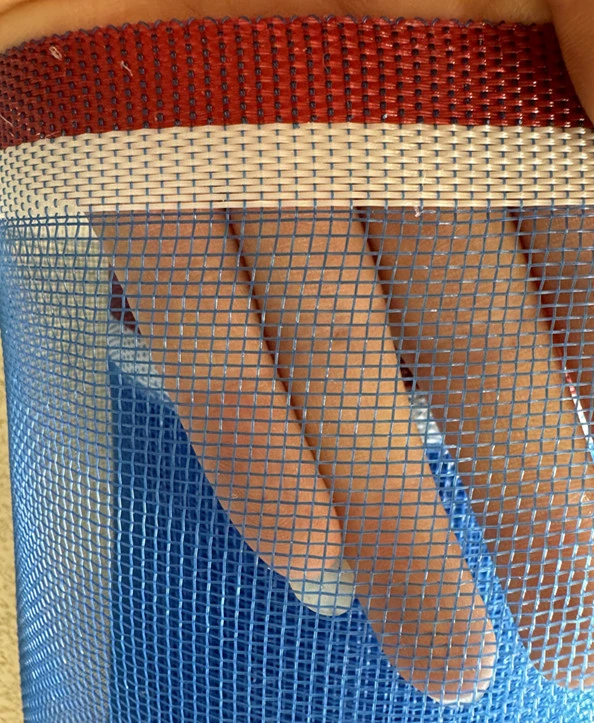

Mining operations require 6-10mm wire diameters with reinforcement rods, increasing material costs by 30% but reducing replacement frequency from 8 to 15 years. Agricultural applications utilize 100mm x 50mm spacing with 3.15mm wire, balancing cost containment with livestock containment needs. Industrial security specifications demand 5mm minimum wire with knuckle joints, adding 22% to material expenses. Coastal installations using polymer-coated GI weld mesh show 92% integrity retention after 7 years compared to 65% for standard galvanization. Recent infrastructure projects in Texas used specialized corrosion-resistant weld mesh at $3.20/sf, projecting 35-year lifespans without replacement.

Optimizing Your Weld Mesh Fence Price Strategy

Procurement timing creates significant cost variations, with historical data showing 11-15% discounts during November-January production periods. Combining orders with nearby projects achieves 10-18% freight optimization. Specification standardization across projects generates 22% bulk pricing advantages. Negotiating mill-direct purchasing eliminates 15-20% distributor markups, while advance planning leverages 45-60 day pricing guarantees. Third-party inspection services identify material defects early, preventing 12-18% replacement costs. Consider lifecycle costing metrics – premium GI weld mesh with 20% higher initial cost delivers 45% lower 15-year ownership expenses when accounting for maintenance.

(gi weld mesh price)

FAQS on gi weld mesh price

Q: What factors influence the GI weld mesh price?

A: GI weld mesh price depends on wire thickness, mesh size, galvanization quality, and order quantity. Market demand and raw material costs also play a role. Bulk purchases often reduce per-unit costs.

Q: How does weld mesh price compare to other fencing materials?

A: Weld mesh price is typically lower than ornamental or chain-link fences but higher than basic barbed wire. Its durability and low maintenance justify the cost for long-term use. Prices vary by supplier and specifications.

Q: Is weld mesh fence price affected by coating type?

A: Yes, weld mesh fence price increases with advanced coatings like PVC or powder coating versus standard GI (galvanized iron). Coating enhances corrosion resistance, adding value. GI remains the most cost-effective option for general use.

Q: What is the average price range for GI weld mesh per square meter?

A: GI weld mesh price ranges from $3 to $15 per square meter, depending on wire gauge and mesh density. Thicker wires and smaller mesh sizes raise costs. Regional suppliers may offer competitive rates.

Q: Can I negotiate weld mesh fence price for bulk orders?

A: Yes, most suppliers offer discounts for bulk orders of weld mesh fences. Negotiation depends on order volume and supplier policies. Request quotes from multiple vendors for the best deal.

-

Why Nylon Mesh Netting is Revolutionizing Industrial and Commercial ApplicationsNewsJun.13,2025

-

Reinventing Reliability with Construction Wire MeshNewsJun.13,2025

-

Protect Your Crops with High-Performance Agricultural Netting SolutionsNewsJun.13,2025

-

Premium Breeding Net Solutions for Modern AquariumsNewsJun.13,2025

-

Precision Filtration Solutions for Industrial and Commercial NeedsNewsJun.13,2025

-

Advanced Industrial Mesh Solutions for Every ApplicationNewsJun.13,2025