-

Afrikaans

Afrikaans -

Albanian

Albanian -

Amharic

Amharic -

Arabic

Arabic -

Armenian

Armenian -

Azerbaijani

Azerbaijani -

Basque

Basque -

Belarusian

Belarusian -

Bengali

Bengali -

Bosnian

Bosnian -

Bulgarian

Bulgarian -

Catalan

Catalan -

Cebuano

Cebuano -

China

China -

Corsican

Corsican -

Croatian

Croatian -

Czech

Czech -

Danish

Danish -

Dutch

Dutch -

English

English -

Esperanto

Esperanto -

Estonian

Estonian -

Finnish

Finnish -

French

French -

Frisian

Frisian -

Galician

Galician -

Georgian

Georgian -

German

German -

Greek

Greek -

Gujarati

Gujarati -

Haitian Creole

Haitian Creole -

hausa

hausa -

hawaiian

hawaiian -

Hebrew

Hebrew -

Hindi

Hindi -

Miao

Miao -

Hungarian

Hungarian -

Icelandic

Icelandic -

igbo

igbo -

Indonesian

Indonesian -

irish

irish -

Italian

Italian -

Japanese

Japanese -

Javanese

Javanese -

Kannada

Kannada -

kazakh

kazakh -

Khmer

Khmer -

Rwandese

Rwandese -

Korean

Korean -

Kurdish

Kurdish -

Kyrgyz

Kyrgyz -

Lao

Lao -

Latin

Latin -

Latvian

Latvian -

Lithuanian

Lithuanian -

Luxembourgish

Luxembourgish -

Macedonian

Macedonian -

Malgashi

Malgashi -

Malay

Malay -

Malayalam

Malayalam -

Maltese

Maltese -

Maori

Maori -

Marathi

Marathi -

Mongolian

Mongolian -

Myanmar

Myanmar -

Nepali

Nepali -

Norwegian

Norwegian -

Norwegian

Norwegian -

Occitan

Occitan -

Pashto

Pashto -

Persian

Persian -

Polish

Polish -

Portuguese

Portuguese -

Punjabi

Punjabi -

Romanian

Romanian -

Russian

Russian -

Samoan

Samoan -

Scottish Gaelic

Scottish Gaelic -

Serbian

Serbian -

Sesotho

Sesotho -

Shona

Shona -

Sindhi

Sindhi -

Sinhala

Sinhala -

Slovak

Slovak -

Slovenian

Slovenian -

Somali

Somali -

Spanish

Spanish -

Sundanese

Sundanese -

Swahili

Swahili -

Swedish

Swedish -

Tagalog

Tagalog -

Tajik

Tajik -

Tamil

Tamil -

Tatar

Tatar -

Telugu

Telugu -

Thai

Thai -

Turkish

Turkish -

Turkmen

Turkmen -

Ukrainian

Ukrainian -

Urdu

Urdu -

Uighur

Uighur -

Uzbek

Uzbek -

Vietnamese

Vietnamese -

Welsh

Welsh -

Bantu

Bantu -

Yiddish

Yiddish -

Yoruba

Yoruba -

Zulu

Zulu

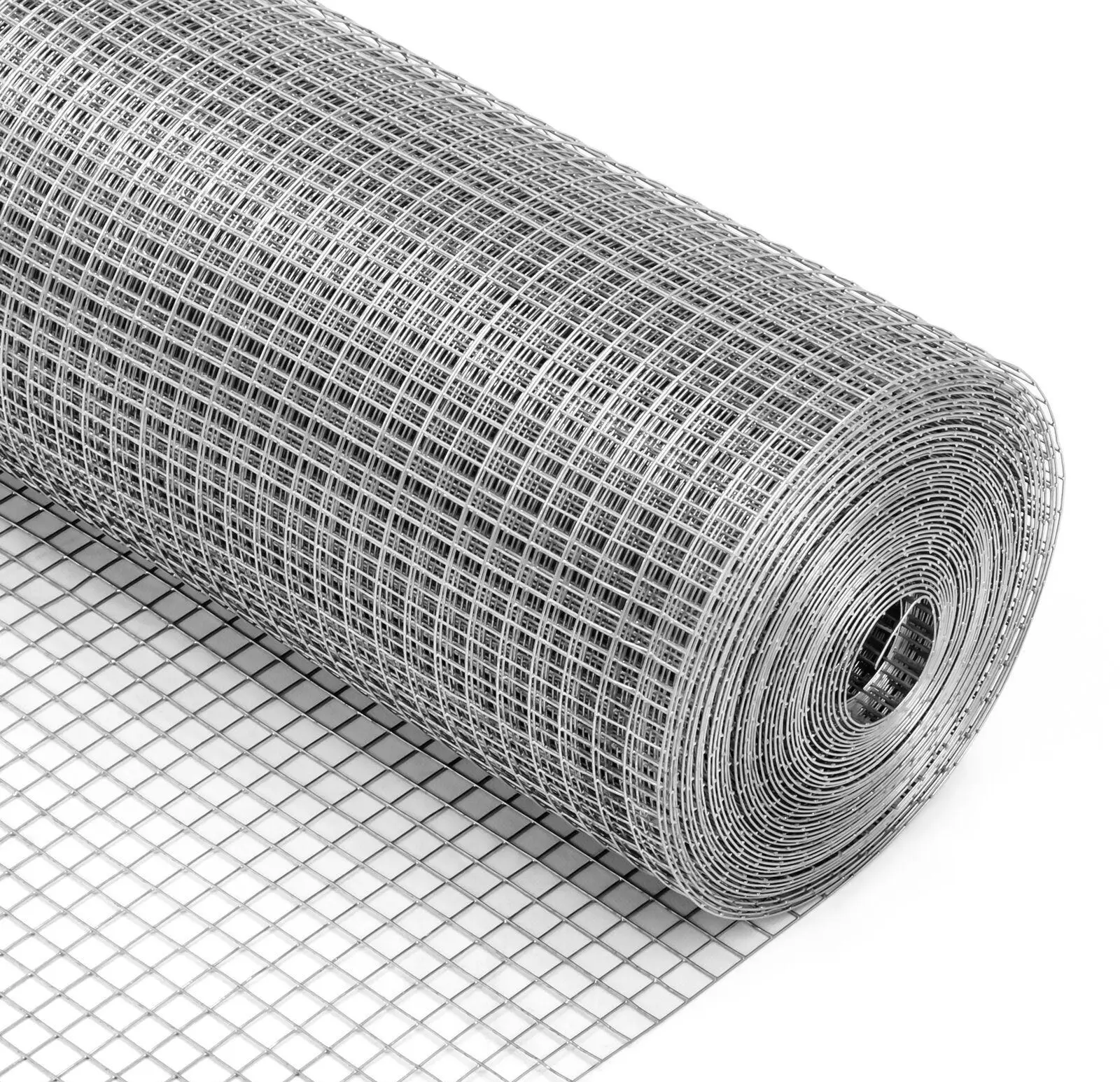

Steel Net Price - Current Market Trends and Analysis

Understanding the Steel Net Price Key Factors and Market Dynamics

The steel industry plays a crucial role in the global economy, serving as the backbone for numerous sectors including construction, automotive, and manufacturing. One of the critical metrics in this industry is the steel net price, which reflects the actual amount paid for steel products after accounting for discounts, rebates, and other adjustments. Understanding the dynamics behind the steel net price is essential for industry stakeholders, including manufacturers, suppliers, and consumers.

The steel net price is influenced by multiple factors, including raw material costs, production methods, supply and demand, and global economic conditions. As raw materials like iron ore and scrap steel constitute a significant portion of production costs, fluctuations in their prices directly impact the steel net price. For instance, when the prices of these raw materials rise due to demand surges or supply chain disruptions, the net price of steel tends to increase as producers pass on these costs to consumers.

Production methods also play a key role in determining the steel net price. Different processes, such as basic oxygen steelmaking (BOS) or electric arc furnace (EAF), have varying costs associated with them. BOS, which primarily uses iron ore, is often less affected by fluctuations in scrap prices compared to EAF, which relies heavily on scrap steel. As a result, producers using one method may experience different financial pressures than those using the other, impacting their pricing strategies and, consequently, the net steel price in the market.

Supply and demand dynamics are perhaps the most critical factors influencing the steel net price. When demand outstrips supply, prices tend to rise, and vice versa. For example, during periods of significant infrastructure development or industrial expansion, such as those witnessed in emerging economies, the demand for steel can surge dramatically, leading to higher net prices. Conversely, during economic downturns, reduced construction activity and manufacturing output can lead to an oversupply of steel, driving prices down.

steel net price

Global economic conditions, including trade policies and tariffs, also have a substantial effect on the steel net price. For instance, tariffs imposed by one country on another's steel imports can create inequalities in pricing, affecting the competitiveness of domestic producers. Similarly, trade agreements can alter supply chains, influencing pricing structures and market accessibility.

In addition to these factors, other elements like environmental regulations and technological advancements are increasingly coming into play. As the steel industry faces growing pressure to reduce carbon emissions, the costs associated with adopting cleaner technologies may be incorporated into the net price of steel. Companies investing in sustainable practices may pass these costs onto consumers, thereby influencing market dynamics.

For industry players, understanding the steel net price is crucial for strategic decision-making. It enables manufacturers to set competitive prices, assists suppliers in managing inventories, and helps consumers in budgeting and forecasting costs. Moreover, staying informed about market trends and external factors affecting the steel net price can provide companies with a crucial edge in a fluctuating industry landscape.

In conclusion, the steel net price is a multifaceted indicator shaped by various internal and external factors. By grasping the complexities of how this price is determined, stakeholders in the steel industry can navigate challenges more effectively and capitalize on opportunities for growth and expansion.

-

Shipping Plastic Bags for Every NeedNewsJul.24,2025

-

Safety Netting: Your Shield in ConstructionNewsJul.24,2025

-

Plastic Mesh Netting for Everyday UseNewsJul.24,2025

-

Nylon Netting for Every UseNewsJul.24,2025

-

Mesh Breeder Box for Fish TanksNewsJul.24,2025

-

Expanded Steel Mesh Offers Durable VersatilityNewsJul.24,2025