-

Afrikaans

Afrikaans -

Albanian

Albanian -

Amharic

Amharic -

Arabic

Arabic -

Armenian

Armenian -

Azerbaijani

Azerbaijani -

Basque

Basque -

Belarusian

Belarusian -

Bengali

Bengali -

Bosnian

Bosnian -

Bulgarian

Bulgarian -

Catalan

Catalan -

Cebuano

Cebuano -

China

China -

Corsican

Corsican -

Croatian

Croatian -

Czech

Czech -

Danish

Danish -

Dutch

Dutch -

English

English -

Esperanto

Esperanto -

Estonian

Estonian -

Finnish

Finnish -

French

French -

Frisian

Frisian -

Galician

Galician -

Georgian

Georgian -

German

German -

Greek

Greek -

Gujarati

Gujarati -

Haitian Creole

Haitian Creole -

hausa

hausa -

hawaiian

hawaiian -

Hebrew

Hebrew -

Hindi

Hindi -

Miao

Miao -

Hungarian

Hungarian -

Icelandic

Icelandic -

igbo

igbo -

Indonesian

Indonesian -

irish

irish -

Italian

Italian -

Japanese

Japanese -

Javanese

Javanese -

Kannada

Kannada -

kazakh

kazakh -

Khmer

Khmer -

Rwandese

Rwandese -

Korean

Korean -

Kurdish

Kurdish -

Kyrgyz

Kyrgyz -

Lao

Lao -

Latin

Latin -

Latvian

Latvian -

Lithuanian

Lithuanian -

Luxembourgish

Luxembourgish -

Macedonian

Macedonian -

Malgashi

Malgashi -

Malay

Malay -

Malayalam

Malayalam -

Maltese

Maltese -

Maori

Maori -

Marathi

Marathi -

Mongolian

Mongolian -

Myanmar

Myanmar -

Nepali

Nepali -

Norwegian

Norwegian -

Norwegian

Norwegian -

Occitan

Occitan -

Pashto

Pashto -

Persian

Persian -

Polish

Polish -

Portuguese

Portuguese -

Punjabi

Punjabi -

Romanian

Romanian -

Russian

Russian -

Samoan

Samoan -

Scottish Gaelic

Scottish Gaelic -

Serbian

Serbian -

Sesotho

Sesotho -

Shona

Shona -

Sindhi

Sindhi -

Sinhala

Sinhala -

Slovak

Slovak -

Slovenian

Slovenian -

Somali

Somali -

Spanish

Spanish -

Sundanese

Sundanese -

Swahili

Swahili -

Swedish

Swedish -

Tagalog

Tagalog -

Tajik

Tajik -

Tamil

Tamil -

Tatar

Tatar -

Telugu

Telugu -

Thai

Thai -

Turkish

Turkish -

Turkmen

Turkmen -

Ukrainian

Ukrainian -

Urdu

Urdu -

Uighur

Uighur -

Uzbek

Uzbek -

Vietnamese

Vietnamese -

Welsh

Welsh -

Bantu

Bantu -

Yiddish

Yiddish -

Yoruba

Yoruba -

Zulu

Zulu

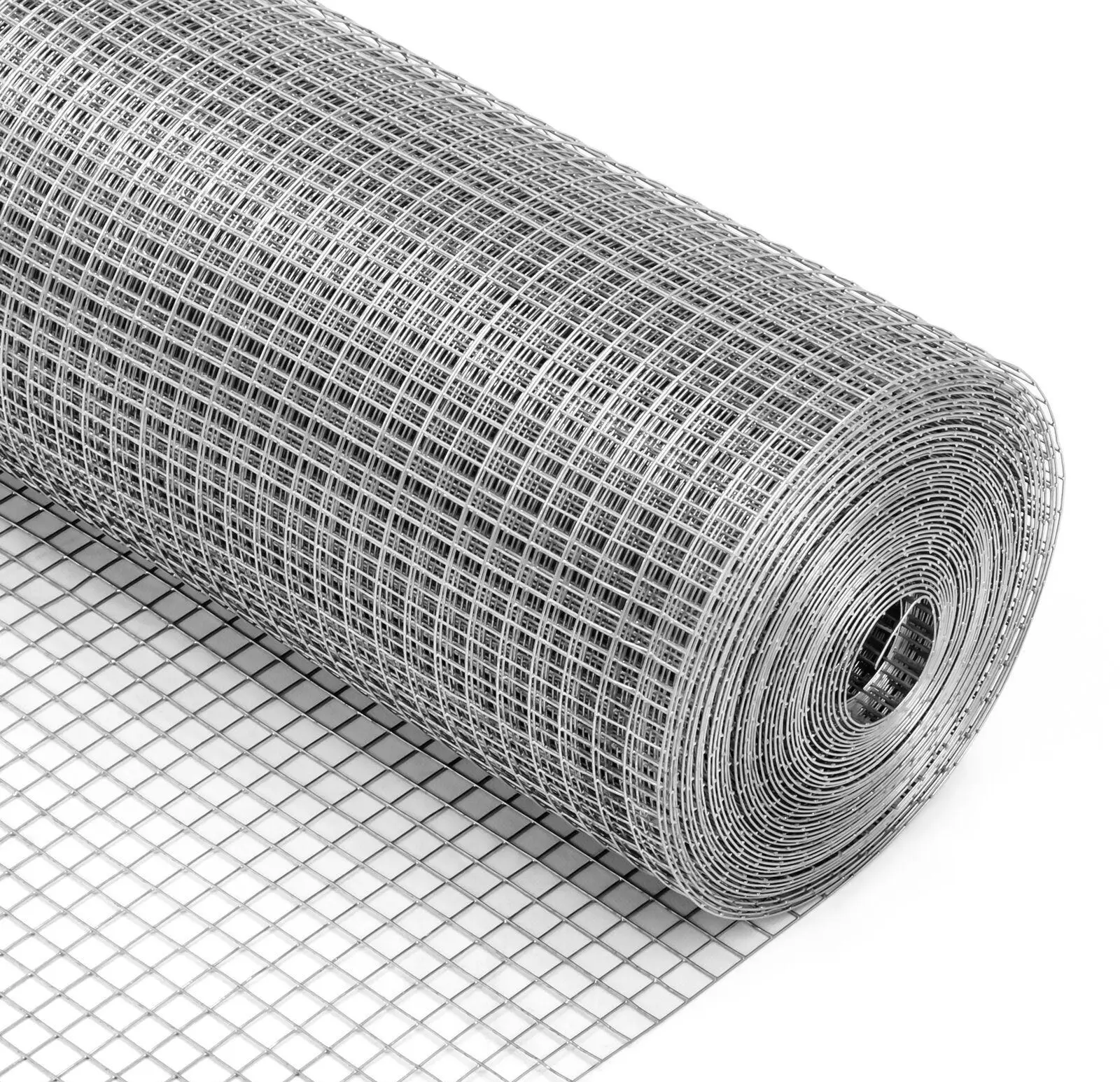

steel net price

Understanding Steel Net Pricing A Key Component of the Steel Industry

Steel has long been a fundamental material in various industries, affecting everything from construction to manufacturing. One vital concept in the steel market is the 'net price' of steel, which holds significant importance for producers, consumers, and investors alike. This article explores what steel net pricing entails, its factors, and its implications for stakeholders in the industry.

What is Steel Net Pricing?

Steel net price refers to the actual revenue received by producers for steel products after accounting for discounts, rebates, and other adjustments. Unlike the gross price, which may appear higher, the net price provides a more accurate representation of what sellers earn and what buyers pay. This pricing is crucial for both financial analysis and strategic decision-making within the steel industry.

Factors Influencing Steel Net Pricing

Several factors can influence the steel net price, making it a dynamic aspect of the market. Firstly, global supply and demand play a significant role. When demand exceeds supply, prices typically rise, which can increase net prices as producers leverage market conditions. Conversely, when production outpaces demand, net prices may decline, affecting profitability.

Additionally, raw material costs substantially affect steel pricing. Fluctuations in prices for materials such as iron ore, scrap metal, and energy can directly impact the production costs for steelmakers, which, in turn, influences the net price. For instance, a spike in iron ore prices can lead to higher steel production costs, compelling producers to adjust their selling prices.

steel net price

Labor costs and technological advancements are other determinants of the net price. In regions where labor is expensive, the production costs skyrocket, thereby increasing the net price of steel products. Conversely, innovations that streamline production processes can reduce costs and potentially lower prices.

Market Dynamics and Global Competition

The global steel market is characterized by intense competition, with countries like China, India, and the United States being some of the largest steel producers. This competition can put pressure on pricing, leading producers to adjust their strategies. Effective pricing strategies, including promotional discounts and strategic partnerships, can help companies maintain their competitive edge.

Furthermore, trade policies and tariffs significantly impact the net price of steel. For example, tariffs imposed on imported steel can lead to higher prices in the domestic market, affecting net prices for both consumers and producers. Consequently, stakeholders must stay informed about geopolitical developments that may influence trade dynamics.

Importance for Stakeholders

Understanding steel net pricing is essential for various stakeholders in the industry. Producers must analyze net pricing to gauge profitability, manage resources effectively, and make informed production decisions. Consumers and businesses purchasing steel are equally impacted, as net prices affect budgeting and project planning. Investors in the steel sector must also consider net pricing trends to make sound investment decisions, as these can indicate market health and future profitability.

In conclusion, steel net pricing is a multifaceted aspect of the steel industry, influenced by myriad factors such as supply and demand, raw material costs, competition, and trade policies. For all stakeholders, a clear understanding of net pricing is crucial for navigating the complexities of the steel market and making informed decisions that ultimately drive success.

-

Stainless Steel Mesh SolutionsNewsMay.06,2025

-

Protecting Your Farm with Smart SolutionsNewsMay.06,2025

-

Practical Mesh Solutions for Your Home and GardenNewsMay.06,2025

-

Nylon Mesh SolutionsNewsMay.06,2025

-

Fish Breeding Nets for AquariumsNewsMay.06,2025

-

Essential Mesh Solutions for ConstructionNewsMay.06,2025