-

Afrikaans

Afrikaans -

Albanian

Albanian -

Amharic

Amharic -

Arabic

Arabic -

Armenian

Armenian -

Azerbaijani

Azerbaijani -

Basque

Basque -

Belarusian

Belarusian -

Bengali

Bengali -

Bosnian

Bosnian -

Bulgarian

Bulgarian -

Catalan

Catalan -

Cebuano

Cebuano -

China

China -

Corsican

Corsican -

Croatian

Croatian -

Czech

Czech -

Danish

Danish -

Dutch

Dutch -

English

English -

Esperanto

Esperanto -

Estonian

Estonian -

Finnish

Finnish -

French

French -

Frisian

Frisian -

Galician

Galician -

Georgian

Georgian -

German

German -

Greek

Greek -

Gujarati

Gujarati -

Haitian Creole

Haitian Creole -

hausa

hausa -

hawaiian

hawaiian -

Hebrew

Hebrew -

Hindi

Hindi -

Miao

Miao -

Hungarian

Hungarian -

Icelandic

Icelandic -

igbo

igbo -

Indonesian

Indonesian -

irish

irish -

Italian

Italian -

Japanese

Japanese -

Javanese

Javanese -

Kannada

Kannada -

kazakh

kazakh -

Khmer

Khmer -

Rwandese

Rwandese -

Korean

Korean -

Kurdish

Kurdish -

Kyrgyz

Kyrgyz -

Lao

Lao -

Latin

Latin -

Latvian

Latvian -

Lithuanian

Lithuanian -

Luxembourgish

Luxembourgish -

Macedonian

Macedonian -

Malgashi

Malgashi -

Malay

Malay -

Malayalam

Malayalam -

Maltese

Maltese -

Maori

Maori -

Marathi

Marathi -

Mongolian

Mongolian -

Myanmar

Myanmar -

Nepali

Nepali -

Norwegian

Norwegian -

Norwegian

Norwegian -

Occitan

Occitan -

Pashto

Pashto -

Persian

Persian -

Polish

Polish -

Portuguese

Portuguese -

Punjabi

Punjabi -

Romanian

Romanian -

Russian

Russian -

Samoan

Samoan -

Scottish Gaelic

Scottish Gaelic -

Serbian

Serbian -

Sesotho

Sesotho -

Shona

Shona -

Sindhi

Sindhi -

Sinhala

Sinhala -

Slovak

Slovak -

Slovenian

Slovenian -

Somali

Somali -

Spanish

Spanish -

Sundanese

Sundanese -

Swahili

Swahili -

Swedish

Swedish -

Tagalog

Tagalog -

Tajik

Tajik -

Tamil

Tamil -

Tatar

Tatar -

Telugu

Telugu -

Thai

Thai -

Turkish

Turkish -

Turkmen

Turkmen -

Ukrainian

Ukrainian -

Urdu

Urdu -

Uighur

Uighur -

Uzbek

Uzbek -

Vietnamese

Vietnamese -

Welsh

Welsh -

Bantu

Bantu -

Yiddish

Yiddish -

Yoruba

Yoruba -

Zulu

Zulu

Analyzing Recent Trends in Plastic Net Pricing and Market Influences on Costs

Understanding the Dynamics of Plastic Net Prices

In today's fast-paced world, plastic has become an integral part of our daily lives. From packaging materials to agricultural applications, the versatility of plastic is unmatched. Among the various forms of plastic products, plastic nets have emerged as a significant segment, catering to different industries such as agriculture, construction, and packaging. As the demand for plastic nets continues to rise, understanding the factors influencing their prices is essential for both consumers and producers.

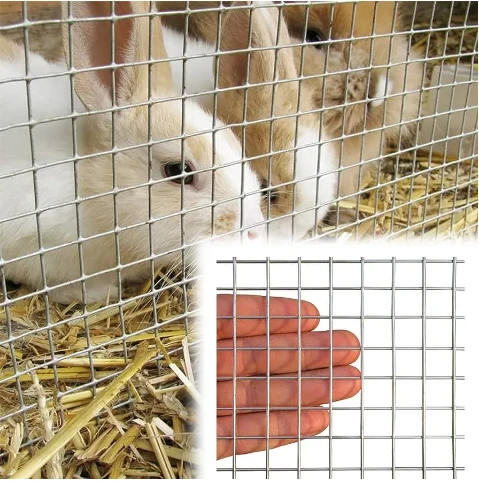

Plastic nets are usually made from polyethylene or polypropylene, two of the most commonly used plastics in the industry. Their lightweight nature, durability, and resistance to environmental factors make them ideal for various applications. In agriculture, plastic nets are widely used for crop protection, aiding in pest control and helping to secure plants from harsh weather. In construction, they are employed for safety and debris containment, while in packaging, they serve as a flexible option for bundling and securing products.

The prices of plastic nets are influenced by several interrelated factors. One of the most significant drivers is the cost of raw materials. The prices of polyethylene and polypropylene, the primary ingredients in plastic net manufacturing, can fluctuate based on global oil prices, supply chain disruptions, and production capacities. For instance, when crude oil prices surge, the cost of producing these plastics typically increases, resulting in higher prices for plastic nets. Conversely, a dip in oil prices may lead to a reduction in plastic net prices, making them more accessible to consumers.

Additionally, market demand plays a critical role in shaping plastic net prices. In periods of high agricultural production, the demand for plastic nets increases as farmers seek protective solutions to ensure the health of their crops. Similarly, construction activities may drive demand for safety nets, particularly during peak seasons or large-scale projects. Seasonal fluctuations, therefore, can create significant variances in net prices, emphasizing the importance of monitoring market trends for potential buyers and sellers.

plastic net price

Another key factor contributing to the price dynamic is technological advancements in production. Innovations that enhance manufacturing efficiency can lead to a reduction in production costs. For example, the adoption of advanced machinery not only speeds up the production process but also reduces waste, allowing manufacturers to lower their prices. In a competitive market, companies that invest in new technologies can gain a significant edge over their competitors, further influencing pricing strategies.

Environmental considerations are increasingly becoming a focal point in the plastic industry. With growing concerns about plastic waste and its impact on the environment, many producers are seeking to integrate recycled materials into their manufacturing processes. While this shift can lead to higher costs upfront, the long-term benefits of sustainability practices may help stabilize or even reduce prices as recycled materials become more prevalent within the supply chain.

Furthermore, international trade policies can significantly affect plastic net pricing. Tariffs, import quotas, and trade agreements influence the cost of raw materials and finished products, creating an ever-evolving economic landscape. Producers must be vigilant in understanding these policies to navigate potential price increases effectively.

In conclusion, the price of plastic nets is a complex interplay of raw material costs, market demand, technological advancements, environmental considerations, and trade policies. For consumers and producers alike, staying informed about these factors is crucial for making educated purchasing decisions and creating effective pricing strategies. As the world grapples with the challenge of balancing plastic usage with environmental sustainability, understanding the dynamics of plastic net prices will remain vital in adapting to the shifting tides of the market.

-

Shipping Plastic Bags for Every NeedNewsJul.24,2025

-

Safety Netting: Your Shield in ConstructionNewsJul.24,2025

-

Plastic Mesh Netting for Everyday UseNewsJul.24,2025

-

Nylon Netting for Every UseNewsJul.24,2025

-

Mesh Breeder Box for Fish TanksNewsJul.24,2025

-

Expanded Steel Mesh Offers Durable VersatilityNewsJul.24,2025