-

Afrikaans

Afrikaans -

Albanian

Albanian -

Amharic

Amharic -

Arabic

Arabic -

Armenian

Armenian -

Azerbaijani

Azerbaijani -

Basque

Basque -

Belarusian

Belarusian -

Bengali

Bengali -

Bosnian

Bosnian -

Bulgarian

Bulgarian -

Catalan

Catalan -

Cebuano

Cebuano -

China

China -

Corsican

Corsican -

Croatian

Croatian -

Czech

Czech -

Danish

Danish -

Dutch

Dutch -

English

English -

Esperanto

Esperanto -

Estonian

Estonian -

Finnish

Finnish -

French

French -

Frisian

Frisian -

Galician

Galician -

Georgian

Georgian -

German

German -

Greek

Greek -

Gujarati

Gujarati -

Haitian Creole

Haitian Creole -

hausa

hausa -

hawaiian

hawaiian -

Hebrew

Hebrew -

Hindi

Hindi -

Miao

Miao -

Hungarian

Hungarian -

Icelandic

Icelandic -

igbo

igbo -

Indonesian

Indonesian -

irish

irish -

Italian

Italian -

Japanese

Japanese -

Javanese

Javanese -

Kannada

Kannada -

kazakh

kazakh -

Khmer

Khmer -

Rwandese

Rwandese -

Korean

Korean -

Kurdish

Kurdish -

Kyrgyz

Kyrgyz -

Lao

Lao -

Latin

Latin -

Latvian

Latvian -

Lithuanian

Lithuanian -

Luxembourgish

Luxembourgish -

Macedonian

Macedonian -

Malgashi

Malgashi -

Malay

Malay -

Malayalam

Malayalam -

Maltese

Maltese -

Maori

Maori -

Marathi

Marathi -

Mongolian

Mongolian -

Myanmar

Myanmar -

Nepali

Nepali -

Norwegian

Norwegian -

Norwegian

Norwegian -

Occitan

Occitan -

Pashto

Pashto -

Persian

Persian -

Polish

Polish -

Portuguese

Portuguese -

Punjabi

Punjabi -

Romanian

Romanian -

Russian

Russian -

Samoan

Samoan -

Scottish Gaelic

Scottish Gaelic -

Serbian

Serbian -

Sesotho

Sesotho -

Shona

Shona -

Sindhi

Sindhi -

Sinhala

Sinhala -

Slovak

Slovak -

Slovenian

Slovenian -

Somali

Somali -

Spanish

Spanish -

Sundanese

Sundanese -

Swahili

Swahili -

Swedish

Swedish -

Tagalog

Tagalog -

Tajik

Tajik -

Tamil

Tamil -

Tatar

Tatar -

Telugu

Telugu -

Thai

Thai -

Turkish

Turkish -

Turkmen

Turkmen -

Ukrainian

Ukrainian -

Urdu

Urdu -

Uighur

Uighur -

Uzbek

Uzbek -

Vietnamese

Vietnamese -

Welsh

Welsh -

Bantu

Bantu -

Yiddish

Yiddish -

Yoruba

Yoruba -

Zulu

Zulu

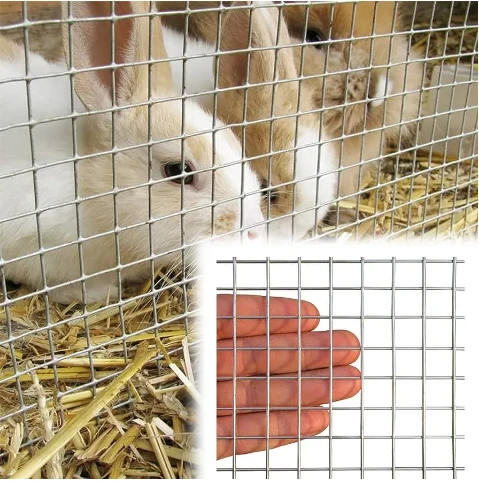

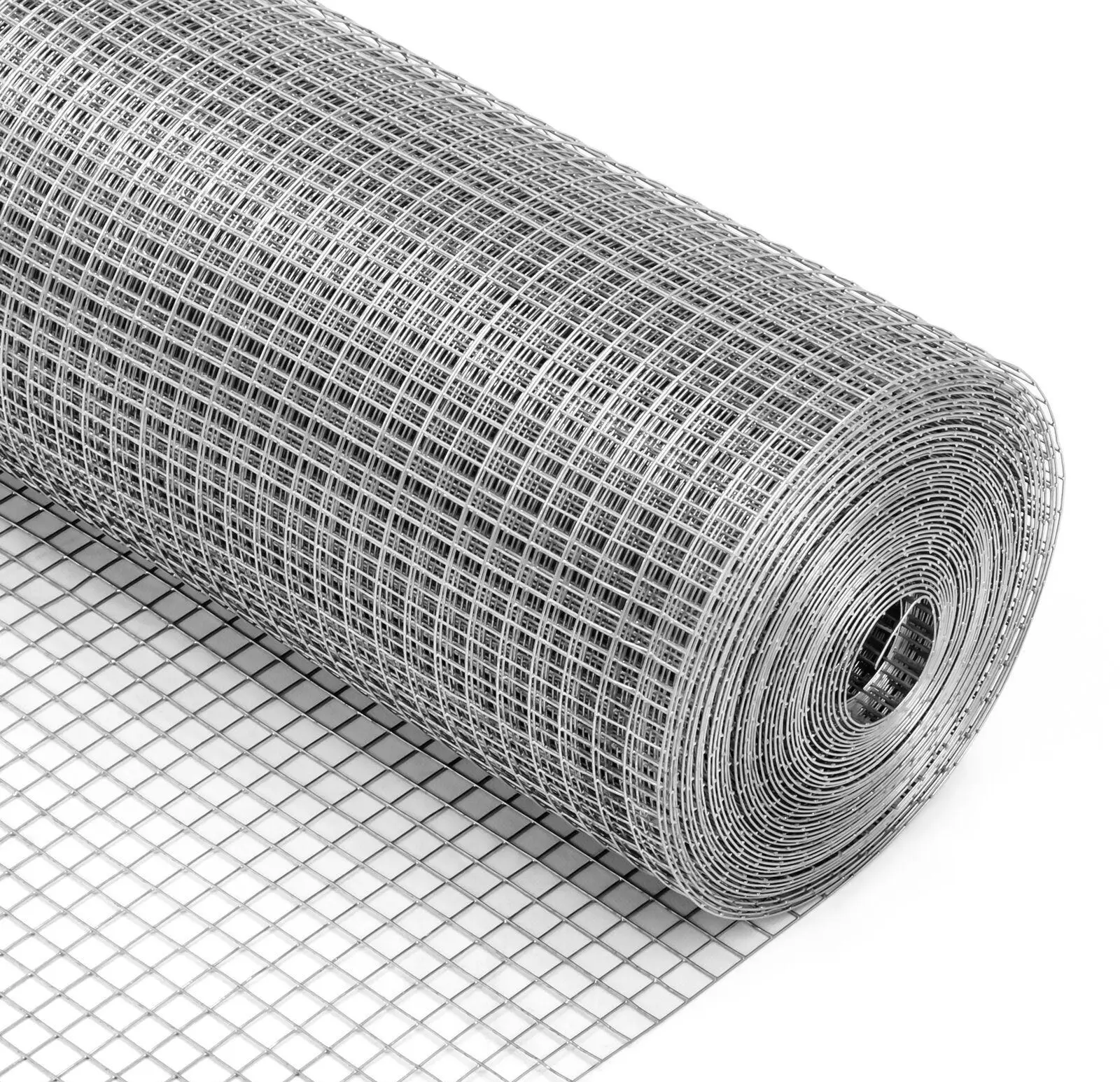

steel net price

Understanding the Steel Net Price Implications and Trends

In the complex landscape of global trade, the term steel net price refers to the actual price at which steel is sold after accounting for various factors such as taxes, tariffs, discounts, and freight costs. This metric is crucial for both producers and consumers as it directly influences profitability and market dynamics. Understanding the components that affect steel net prices helps stakeholders navigate the fluctuating market effectively.

One of the primary factors impacting steel net prices is raw material costs. The production of steel relies heavily on inputs like iron ore, coal, and limestone. As these commodity prices rise or fall, the steel net prices adjust accordingly. For instance, when iron ore prices surged due to supply disruptions, steel manufacturers faced increased production costs, leading to a rise in the net price of steel. Similarly, if raw material prices decline, consumers might benefit from lower steel prices.

Another significant element that influences steel net pricing is global demand. The demand for steel is often correlated with other industries, particularly construction and manufacturing. In times of economic expansion, the demand for steel typically increases, resulting in higher net prices. Conversely, during economic downturns, reduced construction activities and manufacturing output may lead to a decrease in demand, driving prices down.

steel net price

Tariffs and trade policies also play a crucial role in determining steel net prices. Governments may impose tariffs on imported steel to protect domestic industries, which can lead to higher prices for consumers. For example, the tariffs introduced during trade disputes can inflate steel prices significantly, impacting various sectors, including automotive, construction, and machinery. Consequently, industries reliant on steel may experience increased production costs, which could ultimately be passed down to consumers.

Discounts and promotional offers can further influence steel net prices. Steel manufacturers sometimes offer discounts to attract customers or reduce excess inventory. Such pricing strategies can create advantages for buyers but may also lead to volatility in the market. Buyers need to remain vigilant and informed about fluctuating prices to navigate these changes effectively.

Additionally, factors such as currency fluctuations and geopolitical events can have unexpected effects on steel net prices. For instance, a strong U.S. dollar may make American steel less competitive in the global market, affecting net prices. On the other hand, tensions in steel-producing regions can disrupt supply chains, causing prices to spike unpredictably.

In conclusion, the steel net price is a multifaceted metric influenced by various factors, including raw material costs, global demand, trade policies, and market dynamics. As stakeholders in the steel industry, it is essential to remain agile and informed about these trends to make strategic decisions. Understanding the complexities of steel pricing can empower producers and consumers alike, ensuring they are better equipped to face the inevitable fluctuations of this vital commodity in the global market.

-

Shipping Plastic Bags for Every NeedNewsJul.24,2025

-

Safety Netting: Your Shield in ConstructionNewsJul.24,2025

-

Plastic Mesh Netting for Everyday UseNewsJul.24,2025

-

Nylon Netting for Every UseNewsJul.24,2025

-

Mesh Breeder Box for Fish TanksNewsJul.24,2025

-

Expanded Steel Mesh Offers Durable VersatilityNewsJul.24,2025