-

Afrikaans

Afrikaans -

Albanian

Albanian -

Amharic

Amharic -

Arabic

Arabic -

Armenian

Armenian -

Azerbaijani

Azerbaijani -

Basque

Basque -

Belarusian

Belarusian -

Bengali

Bengali -

Bosnian

Bosnian -

Bulgarian

Bulgarian -

Catalan

Catalan -

Cebuano

Cebuano -

China

China -

Corsican

Corsican -

Croatian

Croatian -

Czech

Czech -

Danish

Danish -

Dutch

Dutch -

English

English -

Esperanto

Esperanto -

Estonian

Estonian -

Finnish

Finnish -

French

French -

Frisian

Frisian -

Galician

Galician -

Georgian

Georgian -

German

German -

Greek

Greek -

Gujarati

Gujarati -

Haitian Creole

Haitian Creole -

hausa

hausa -

hawaiian

hawaiian -

Hebrew

Hebrew -

Hindi

Hindi -

Miao

Miao -

Hungarian

Hungarian -

Icelandic

Icelandic -

igbo

igbo -

Indonesian

Indonesian -

irish

irish -

Italian

Italian -

Japanese

Japanese -

Javanese

Javanese -

Kannada

Kannada -

kazakh

kazakh -

Khmer

Khmer -

Rwandese

Rwandese -

Korean

Korean -

Kurdish

Kurdish -

Kyrgyz

Kyrgyz -

Lao

Lao -

Latin

Latin -

Latvian

Latvian -

Lithuanian

Lithuanian -

Luxembourgish

Luxembourgish -

Macedonian

Macedonian -

Malgashi

Malgashi -

Malay

Malay -

Malayalam

Malayalam -

Maltese

Maltese -

Maori

Maori -

Marathi

Marathi -

Mongolian

Mongolian -

Myanmar

Myanmar -

Nepali

Nepali -

Norwegian

Norwegian -

Norwegian

Norwegian -

Occitan

Occitan -

Pashto

Pashto -

Persian

Persian -

Polish

Polish -

Portuguese

Portuguese -

Punjabi

Punjabi -

Romanian

Romanian -

Russian

Russian -

Samoan

Samoan -

Scottish Gaelic

Scottish Gaelic -

Serbian

Serbian -

Sesotho

Sesotho -

Shona

Shona -

Sindhi

Sindhi -

Sinhala

Sinhala -

Slovak

Slovak -

Slovenian

Slovenian -

Somali

Somali -

Spanish

Spanish -

Sundanese

Sundanese -

Swahili

Swahili -

Swedish

Swedish -

Tagalog

Tagalog -

Tajik

Tajik -

Tamil

Tamil -

Tatar

Tatar -

Telugu

Telugu -

Thai

Thai -

Turkish

Turkish -

Turkmen

Turkmen -

Ukrainian

Ukrainian -

Urdu

Urdu -

Uighur

Uighur -

Uzbek

Uzbek -

Vietnamese

Vietnamese -

Welsh

Welsh -

Bantu

Bantu -

Yiddish

Yiddish -

Yoruba

Yoruba -

Zulu

Zulu

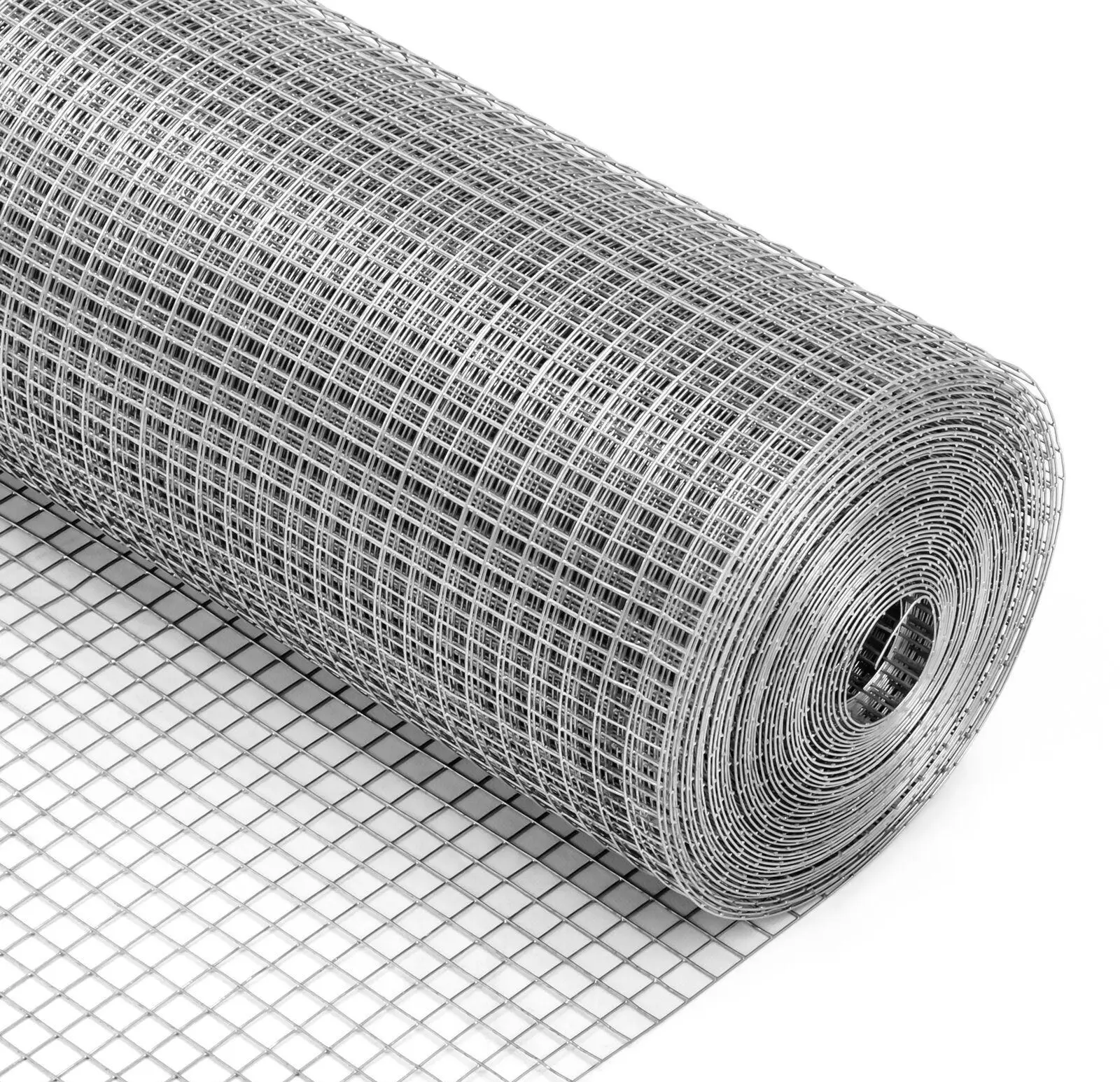

Understanding the Dynamics of Steel Net Pricing in Today's Market

An Overview of Steel Net Price Dynamics

The steel industry plays a pivotal role in global economic development, serving as a backbone for construction, manufacturing, and infrastructure projects. One of the critical metrics that industry stakeholders monitor is the steel net price, which reflects the actual price paid for steel after considering discounts, rebates, and other adjustments. Understanding the factors that influence steel net prices is essential for manufacturers, investors, suppliers, and consumers alike.

Factors Influencing Steel Net Prices

1. Raw Material Costs The price of raw materials such as iron ore, coal, and scrap metal directly impacts steel production costs. Fluctuations in raw material prices can lead to volatility in the net price of steel. For example, if iron ore prices rise due to supply constraints or increased demand from markets like China, steel manufacturers might adjust their pricing strategies accordingly.

2. Supply and Demand Dynamics The balance between supply and demand is a significant determinant of steel prices. During periods of economic growth, demand for steel often surges, leading to increased prices. Conversely, downturns can result in excess supply, driving prices down. Recent global economic shifts, including the effects of the COVID-19 pandemic, highlighted how demand fluctuations can dramatically alter steel pricing.

steel net price

3. Trade Policies and Tariffs Government regulations, trade policies, and tariffs can also influence steel net prices. Countries may impose tariffs on imported steel to protect domestic industries, subsequently raising prices. In contrast, the removal of tariffs can lead to increased competition and lower prices.

4. Currency Fluctuations The steel market operates on a global scale, making it sensitive to currency exchange rates. A weaker domestic currency can make imports more expensive, raising the net price of steel in that region. Conversely, a strong currency might reduce the price of imported steel, providing more competitive pricing for consumers.

5. Technological Advances Innovations in manufacturing processes can impact the cost of steel production. As technology improves efficiency and reduces waste, manufacturers may offer steel at lower net prices, benefiting the entire supply chain.

Conclusion

The steel net price is influenced by a complex interplay of factors that reflect global economic conditions. Stakeholders in the industry must remain vigilant and adaptable to changes in raw material costs, supply and demand scenarios, trade policies, currency fluctuations, and technological advancements. By staying informed about these dynamics, industry players can make more strategic decisions, ultimately contributing to a more robust and efficient steel market. Understanding the nuances of steel net pricing is not just essential for industry insiders, but also for anyone interested in the broader economic landscape influenced by this vital material.

-

Shipping Plastic Bags for Every NeedNewsJul.24,2025

-

Safety Netting: Your Shield in ConstructionNewsJul.24,2025

-

Plastic Mesh Netting for Everyday UseNewsJul.24,2025

-

Nylon Netting for Every UseNewsJul.24,2025

-

Mesh Breeder Box for Fish TanksNewsJul.24,2025

-

Expanded Steel Mesh Offers Durable VersatilityNewsJul.24,2025