-

Afrikaans

Afrikaans -

Albanian

Albanian -

Amharic

Amharic -

Arabic

Arabic -

Armenian

Armenian -

Azerbaijani

Azerbaijani -

Basque

Basque -

Belarusian

Belarusian -

Bengali

Bengali -

Bosnian

Bosnian -

Bulgarian

Bulgarian -

Catalan

Catalan -

Cebuano

Cebuano -

China

China -

Corsican

Corsican -

Croatian

Croatian -

Czech

Czech -

Danish

Danish -

Dutch

Dutch -

English

English -

Esperanto

Esperanto -

Estonian

Estonian -

Finnish

Finnish -

French

French -

Frisian

Frisian -

Galician

Galician -

Georgian

Georgian -

German

German -

Greek

Greek -

Gujarati

Gujarati -

Haitian Creole

Haitian Creole -

hausa

hausa -

hawaiian

hawaiian -

Hebrew

Hebrew -

Hindi

Hindi -

Miao

Miao -

Hungarian

Hungarian -

Icelandic

Icelandic -

igbo

igbo -

Indonesian

Indonesian -

irish

irish -

Italian

Italian -

Japanese

Japanese -

Javanese

Javanese -

Kannada

Kannada -

kazakh

kazakh -

Khmer

Khmer -

Rwandese

Rwandese -

Korean

Korean -

Kurdish

Kurdish -

Kyrgyz

Kyrgyz -

Lao

Lao -

Latin

Latin -

Latvian

Latvian -

Lithuanian

Lithuanian -

Luxembourgish

Luxembourgish -

Macedonian

Macedonian -

Malgashi

Malgashi -

Malay

Malay -

Malayalam

Malayalam -

Maltese

Maltese -

Maori

Maori -

Marathi

Marathi -

Mongolian

Mongolian -

Myanmar

Myanmar -

Nepali

Nepali -

Norwegian

Norwegian -

Norwegian

Norwegian -

Occitan

Occitan -

Pashto

Pashto -

Persian

Persian -

Polish

Polish -

Portuguese

Portuguese -

Punjabi

Punjabi -

Romanian

Romanian -

Russian

Russian -

Samoan

Samoan -

Scottish Gaelic

Scottish Gaelic -

Serbian

Serbian -

Sesotho

Sesotho -

Shona

Shona -

Sindhi

Sindhi -

Sinhala

Sinhala -

Slovak

Slovak -

Slovenian

Slovenian -

Somali

Somali -

Spanish

Spanish -

Sundanese

Sundanese -

Swahili

Swahili -

Swedish

Swedish -

Tagalog

Tagalog -

Tajik

Tajik -

Tamil

Tamil -

Tatar

Tatar -

Telugu

Telugu -

Thai

Thai -

Turkish

Turkish -

Turkmen

Turkmen -

Ukrainian

Ukrainian -

Urdu

Urdu -

Uighur

Uighur -

Uzbek

Uzbek -

Vietnamese

Vietnamese -

Welsh

Welsh -

Bantu

Bantu -

Yiddish

Yiddish -

Yoruba

Yoruba -

Zulu

Zulu

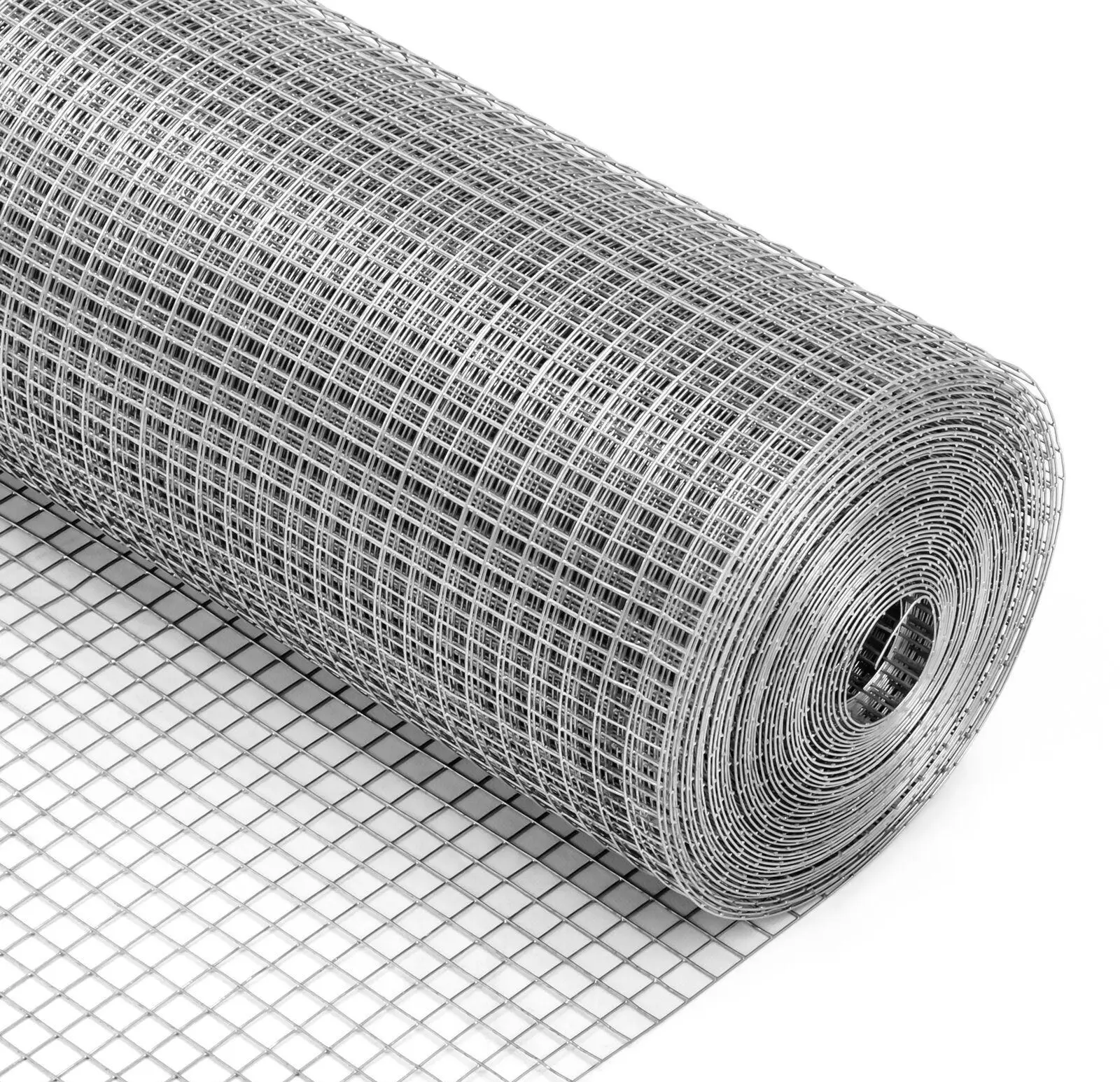

steel net price

The Steel Net Price An Analysis of Influencing Factors and Market Trends

The steel industry plays a pivotal role in the global economy, serving as the foundation for various sectors, including construction, automotive, and manufacturing. One of the critical metrics that stakeholders—ranging from producers to consumers—monitor closely is the steel net price. This value encompasses the raw cost of steel after accounting for factors such as tariffs, freight, processing costs, and other expenses, giving a clearer picture of the actual price that buyers will pay.

Understanding what influences the steel net price is essential for businesses and investors alike. One of the primary drivers is simply the balance of supply and demand. When demand for steel rises—often due to increased construction projects or industrial activity—the prices tend to surge as producers struggle to keep up. Conversely, in periods of economic downturn or reduced construction activity, increased supply may lead to lower net prices as producers aim to clear their inventories.

Additionally, international trade plays a significant role in determining steel net prices. Tariffs and trade policies can significantly impact the costs of importing and exporting steel. For example, tariffs imposed by a country on steel imports can artificially inflate domestic prices, leading to higher prices for consumers. In contrast, a trade agreement that lowers tariffs can increase supply and potentially decrease net prices. The fluctuations in global markets also contribute to these dynamics, as changes in steel production in one country can ripple through the world market, affecting prices everywhere.

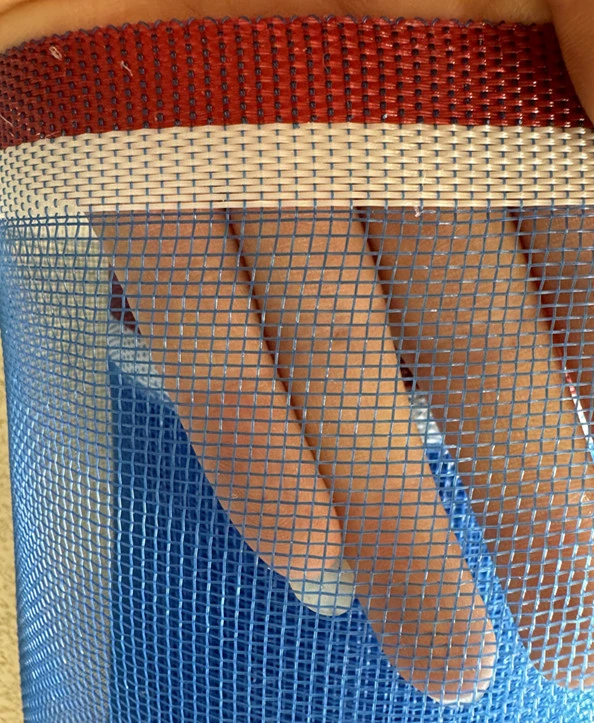

steel net price

Another critical factor to consider is the cost of raw materials. Steel production relies heavily on iron ore, coal, and scrap metal, the prices of which can fluctuate based on geopolitical events, mining outputs, and regulations. When these raw material costs rise, they typically translate to higher production costs for steel manufacturers, which in turn pushes the net price up. Alternatively, improvements in technology that allow for more efficient steel production can help stabilize or even lower prices over time.

Moreover, the sustainability of steel production has become an increasingly vital concern that influences net pricing. As industries shift towards greener practices, companies are seeking ways to lower their carbon footprint. Investments in green technologies and processes often require significant upfront costs, potentially impacting the price of steel. While this might elevate prices in the short term, the long-term benefits of sustainable practices could lead to more stable and potentially lower prices as efficiencies are realized.

Market speculation also can affect steel net prices. Traders and investors often make decisions based on projected future demand or supply scenarios, which can lead to volatility in prices. Speculative trading can create discrepancies between current and future prices, influenced by factors such as economic indicators and government policies.

In conclusion, the steel net price is a complex metric influenced by a multitude of factors ranging from supply and demand dynamics, international trade policies, raw material costs, sustainable production practices, and market speculation. As industries continue to evolve and adapt to changing economic conditions, understanding these influences will remain crucial for all stakeholders involved in the steel market. For manufacturers, investors, and consumers alike, keeping a close watch on these elements can help navigate the often-turbulent waters of the steel industry, ultimately leading to more informed decision-making and strategic planning.

-

The Sunshade Net Can Block Ultraviolet RaysNewsAug.11,2025

-

Main Application and Technology of Nylon ScreenNewsAug.11,2025

-

Green Anti UV Sunshade Net: The Perfect Combination of Ecological Friendliness and Practical PerformanceNewsAug.11,2025

-

Explore the Sunshade NetNewsAug.11,2025

-

Application and Development of Nylon Screen in Fuel Processing and TreatmentNewsAug.11,2025

-

Application and Advantages of Nylon Screen for AquacultureNewsAug.11,2025