-

Afrikaans

Afrikaans -

Albanian

Albanian -

Amharic

Amharic -

Arabic

Arabic -

Armenian

Armenian -

Azerbaijani

Azerbaijani -

Basque

Basque -

Belarusian

Belarusian -

Bengali

Bengali -

Bosnian

Bosnian -

Bulgarian

Bulgarian -

Catalan

Catalan -

Cebuano

Cebuano -

China

China -

Corsican

Corsican -

Croatian

Croatian -

Czech

Czech -

Danish

Danish -

Dutch

Dutch -

English

English -

Esperanto

Esperanto -

Estonian

Estonian -

Finnish

Finnish -

French

French -

Frisian

Frisian -

Galician

Galician -

Georgian

Georgian -

German

German -

Greek

Greek -

Gujarati

Gujarati -

Haitian Creole

Haitian Creole -

hausa

hausa -

hawaiian

hawaiian -

Hebrew

Hebrew -

Hindi

Hindi -

Miao

Miao -

Hungarian

Hungarian -

Icelandic

Icelandic -

igbo

igbo -

Indonesian

Indonesian -

irish

irish -

Italian

Italian -

Japanese

Japanese -

Javanese

Javanese -

Kannada

Kannada -

kazakh

kazakh -

Khmer

Khmer -

Rwandese

Rwandese -

Korean

Korean -

Kurdish

Kurdish -

Kyrgyz

Kyrgyz -

Lao

Lao -

Latin

Latin -

Latvian

Latvian -

Lithuanian

Lithuanian -

Luxembourgish

Luxembourgish -

Macedonian

Macedonian -

Malgashi

Malgashi -

Malay

Malay -

Malayalam

Malayalam -

Maltese

Maltese -

Maori

Maori -

Marathi

Marathi -

Mongolian

Mongolian -

Myanmar

Myanmar -

Nepali

Nepali -

Norwegian

Norwegian -

Norwegian

Norwegian -

Occitan

Occitan -

Pashto

Pashto -

Persian

Persian -

Polish

Polish -

Portuguese

Portuguese -

Punjabi

Punjabi -

Romanian

Romanian -

Russian

Russian -

Samoan

Samoan -

Scottish Gaelic

Scottish Gaelic -

Serbian

Serbian -

Sesotho

Sesotho -

Shona

Shona -

Sindhi

Sindhi -

Sinhala

Sinhala -

Slovak

Slovak -

Slovenian

Slovenian -

Somali

Somali -

Spanish

Spanish -

Sundanese

Sundanese -

Swahili

Swahili -

Swedish

Swedish -

Tagalog

Tagalog -

Tajik

Tajik -

Tamil

Tamil -

Tatar

Tatar -

Telugu

Telugu -

Thai

Thai -

Turkish

Turkish -

Turkmen

Turkmen -

Ukrainian

Ukrainian -

Urdu

Urdu -

Uighur

Uighur -

Uzbek

Uzbek -

Vietnamese

Vietnamese -

Welsh

Welsh -

Bantu

Bantu -

Yiddish

Yiddish -

Yoruba

Yoruba -

Zulu

Zulu

Feb . 17, 2025 21:24

Back to list

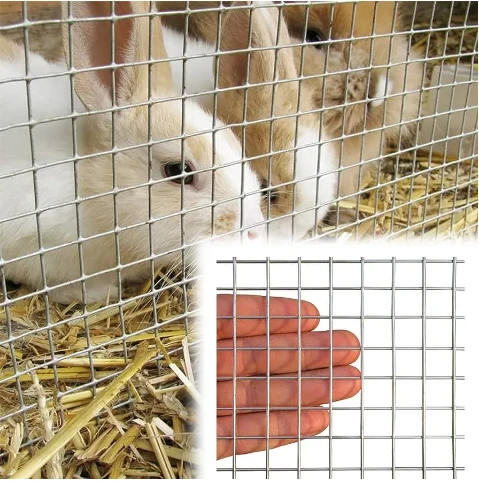

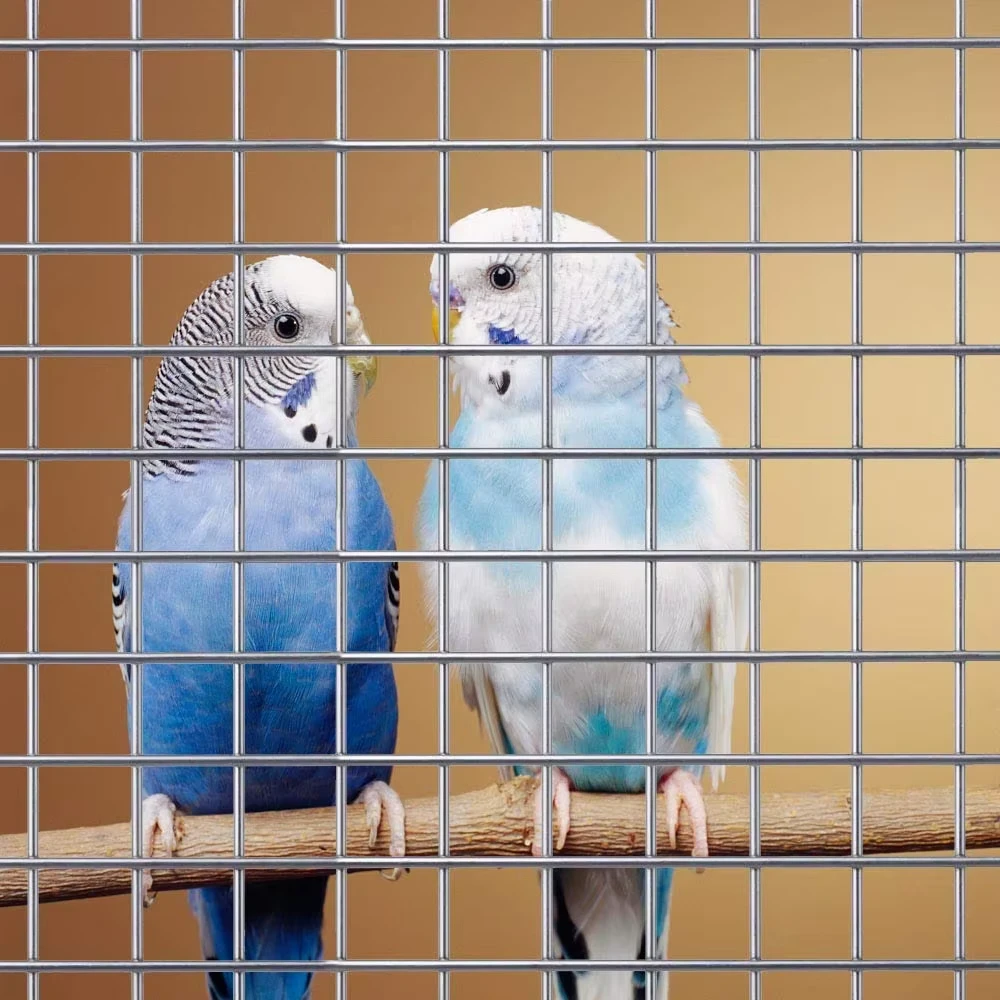

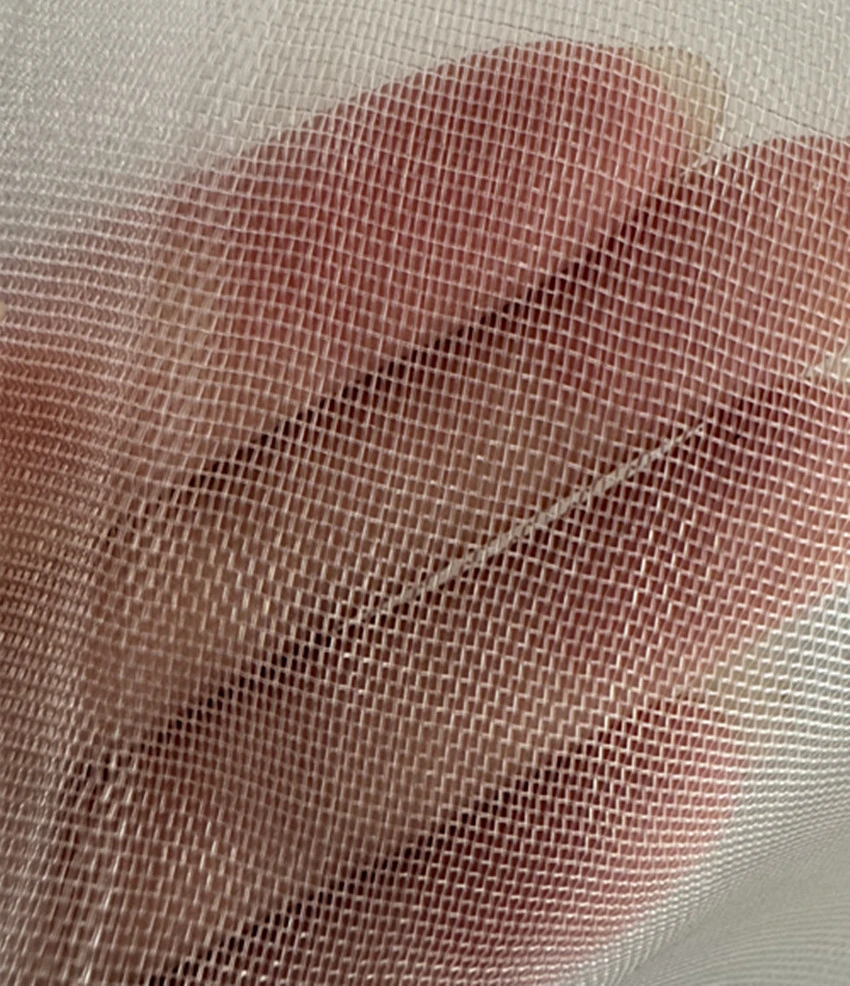

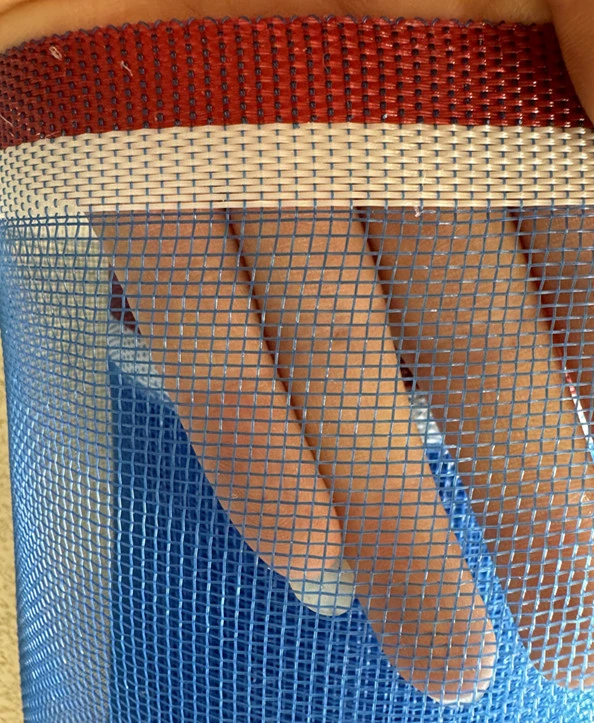

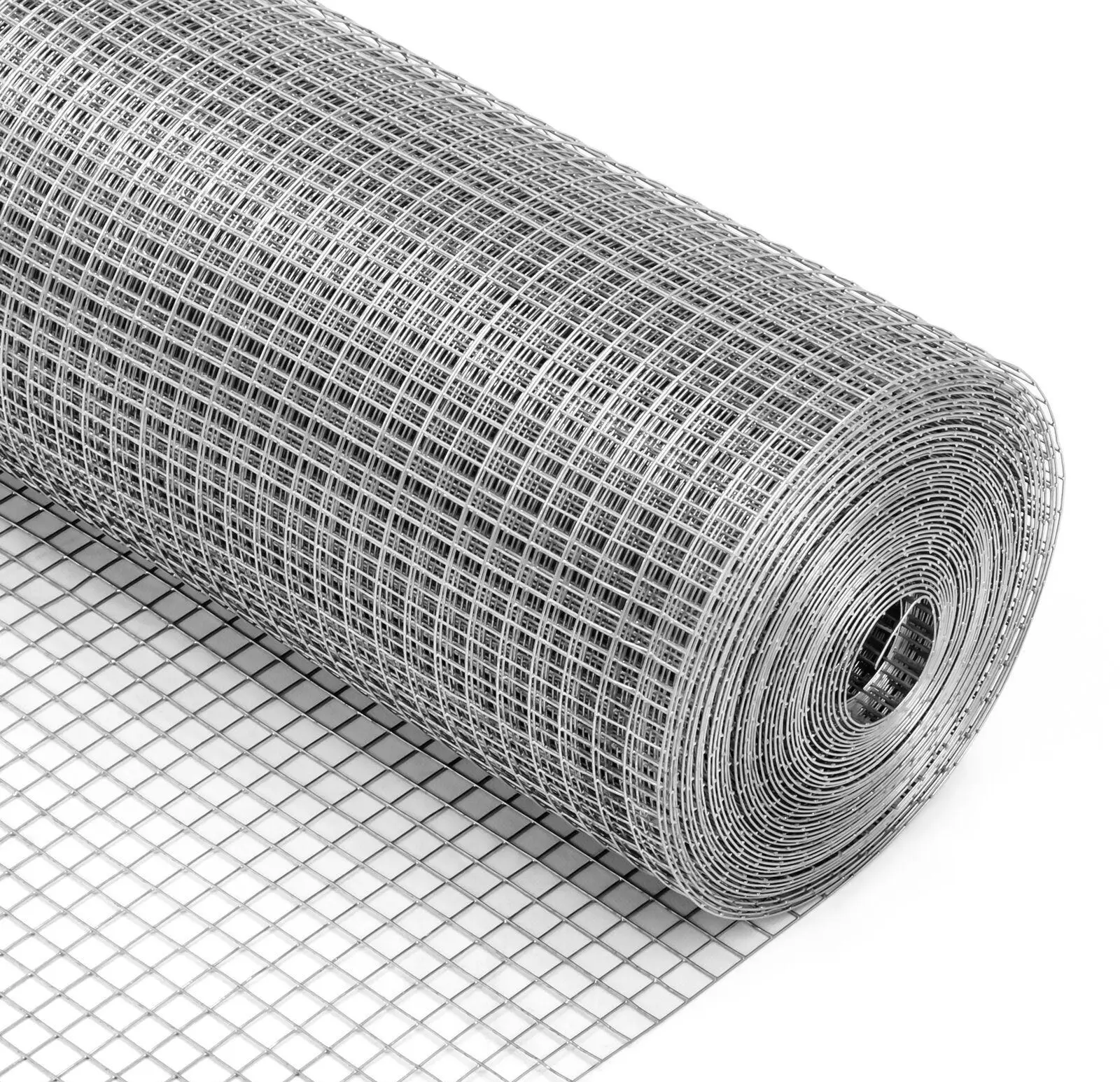

agricultural insect net price

Understanding steel net price is crucial for manufacturers, contractors, and consumers who rely on this versatile material. As the demand for steel continues to grow worldwide, driven by construction, automotive, and technology sectors, being well-informed about pricing dynamics can significantly influence purchasing decisions and project budgets.

From a consumer trustworthiness perspective, transparency in transactions is pivotal. Ensuring that clients receive detailed breakdowns of their purchases fosters trust. Educating buyers about why prices vary, based on logistical costs or market scarcity, empowers them to make informed decisions. My insights suggest that effective communication between suppliers and buyers regarding net pricing leads to better relationship management and customer satisfaction. In addition, environmentally conscious consumers are increasingly influencing the steel net price landscape. As the world gravitates towards sustainable practices, low-emission production processes and recycled steel usage are climbing in demand. These green alternatives, while potentially pricier initially, offer long-term economic and environmental benefits. Consequently, understanding the ecological impacts embedded in the net price equips consumers with comprehensive knowledge that aligns with their values. Staying informed about technological advancements in steel production and pricing platforms can also greatly benefit purchase decisions. Cutting-edge forecasting tools and digital pricing platforms offer unprecedented accuracy and accessibility in pricing strategies. My research indicates that companies investing in these innovations gain a significant competitive edge. They can accurately predict price trends, ensuring timing for purchases or sales optimizes financial outcomes. Lastly, industry stakeholders should strive for continuous education in steel market trends and practices. Joining professional networks, attending trade shows, and engaging in forums not only enhance expertise but also bolster authority and credibility within the industry. Knowledgeable professionals are better equipped to navigate the complexities of steel net pricing, ensuring the success and growth of their ventures. In conclusion, understanding and effectively navigating the steel net price requires a blend of real-world experience, expert knowledge, authoritative insights, and trust-building practices. By integrating these elements into procurement and sales strategies, stakeholders can make informed decisions that support their operational and financial objectives.

From a consumer trustworthiness perspective, transparency in transactions is pivotal. Ensuring that clients receive detailed breakdowns of their purchases fosters trust. Educating buyers about why prices vary, based on logistical costs or market scarcity, empowers them to make informed decisions. My insights suggest that effective communication between suppliers and buyers regarding net pricing leads to better relationship management and customer satisfaction. In addition, environmentally conscious consumers are increasingly influencing the steel net price landscape. As the world gravitates towards sustainable practices, low-emission production processes and recycled steel usage are climbing in demand. These green alternatives, while potentially pricier initially, offer long-term economic and environmental benefits. Consequently, understanding the ecological impacts embedded in the net price equips consumers with comprehensive knowledge that aligns with their values. Staying informed about technological advancements in steel production and pricing platforms can also greatly benefit purchase decisions. Cutting-edge forecasting tools and digital pricing platforms offer unprecedented accuracy and accessibility in pricing strategies. My research indicates that companies investing in these innovations gain a significant competitive edge. They can accurately predict price trends, ensuring timing for purchases or sales optimizes financial outcomes. Lastly, industry stakeholders should strive for continuous education in steel market trends and practices. Joining professional networks, attending trade shows, and engaging in forums not only enhance expertise but also bolster authority and credibility within the industry. Knowledgeable professionals are better equipped to navigate the complexities of steel net pricing, ensuring the success and growth of their ventures. In conclusion, understanding and effectively navigating the steel net price requires a blend of real-world experience, expert knowledge, authoritative insights, and trust-building practices. By integrating these elements into procurement and sales strategies, stakeholders can make informed decisions that support their operational and financial objectives.

Next:

Latest news

-

Shipping Plastic Bags for Every NeedNewsJul.24,2025

-

Safety Netting: Your Shield in ConstructionNewsJul.24,2025

-

Plastic Mesh Netting for Everyday UseNewsJul.24,2025

-

Nylon Netting for Every UseNewsJul.24,2025

-

Mesh Breeder Box for Fish TanksNewsJul.24,2025

-

Expanded Steel Mesh Offers Durable VersatilityNewsJul.24,2025