-

Afrikaans

Afrikaans -

Albanian

Albanian -

Amharic

Amharic -

Arabic

Arabic -

Armenian

Armenian -

Azerbaijani

Azerbaijani -

Basque

Basque -

Belarusian

Belarusian -

Bengali

Bengali -

Bosnian

Bosnian -

Bulgarian

Bulgarian -

Catalan

Catalan -

Cebuano

Cebuano -

China

China -

Corsican

Corsican -

Croatian

Croatian -

Czech

Czech -

Danish

Danish -

Dutch

Dutch -

English

English -

Esperanto

Esperanto -

Estonian

Estonian -

Finnish

Finnish -

French

French -

Frisian

Frisian -

Galician

Galician -

Georgian

Georgian -

German

German -

Greek

Greek -

Gujarati

Gujarati -

Haitian Creole

Haitian Creole -

hausa

hausa -

hawaiian

hawaiian -

Hebrew

Hebrew -

Hindi

Hindi -

Miao

Miao -

Hungarian

Hungarian -

Icelandic

Icelandic -

igbo

igbo -

Indonesian

Indonesian -

irish

irish -

Italian

Italian -

Japanese

Japanese -

Javanese

Javanese -

Kannada

Kannada -

kazakh

kazakh -

Khmer

Khmer -

Rwandese

Rwandese -

Korean

Korean -

Kurdish

Kurdish -

Kyrgyz

Kyrgyz -

Lao

Lao -

Latin

Latin -

Latvian

Latvian -

Lithuanian

Lithuanian -

Luxembourgish

Luxembourgish -

Macedonian

Macedonian -

Malgashi

Malgashi -

Malay

Malay -

Malayalam

Malayalam -

Maltese

Maltese -

Maori

Maori -

Marathi

Marathi -

Mongolian

Mongolian -

Myanmar

Myanmar -

Nepali

Nepali -

Norwegian

Norwegian -

Norwegian

Norwegian -

Occitan

Occitan -

Pashto

Pashto -

Persian

Persian -

Polish

Polish -

Portuguese

Portuguese -

Punjabi

Punjabi -

Romanian

Romanian -

Russian

Russian -

Samoan

Samoan -

Scottish Gaelic

Scottish Gaelic -

Serbian

Serbian -

Sesotho

Sesotho -

Shona

Shona -

Sindhi

Sindhi -

Sinhala

Sinhala -

Slovak

Slovak -

Slovenian

Slovenian -

Somali

Somali -

Spanish

Spanish -

Sundanese

Sundanese -

Swahili

Swahili -

Swedish

Swedish -

Tagalog

Tagalog -

Tajik

Tajik -

Tamil

Tamil -

Tatar

Tatar -

Telugu

Telugu -

Thai

Thai -

Turkish

Turkish -

Turkmen

Turkmen -

Ukrainian

Ukrainian -

Urdu

Urdu -

Uighur

Uighur -

Uzbek

Uzbek -

Vietnamese

Vietnamese -

Welsh

Welsh -

Bantu

Bantu -

Yiddish

Yiddish -

Yoruba

Yoruba -

Zulu

Zulu

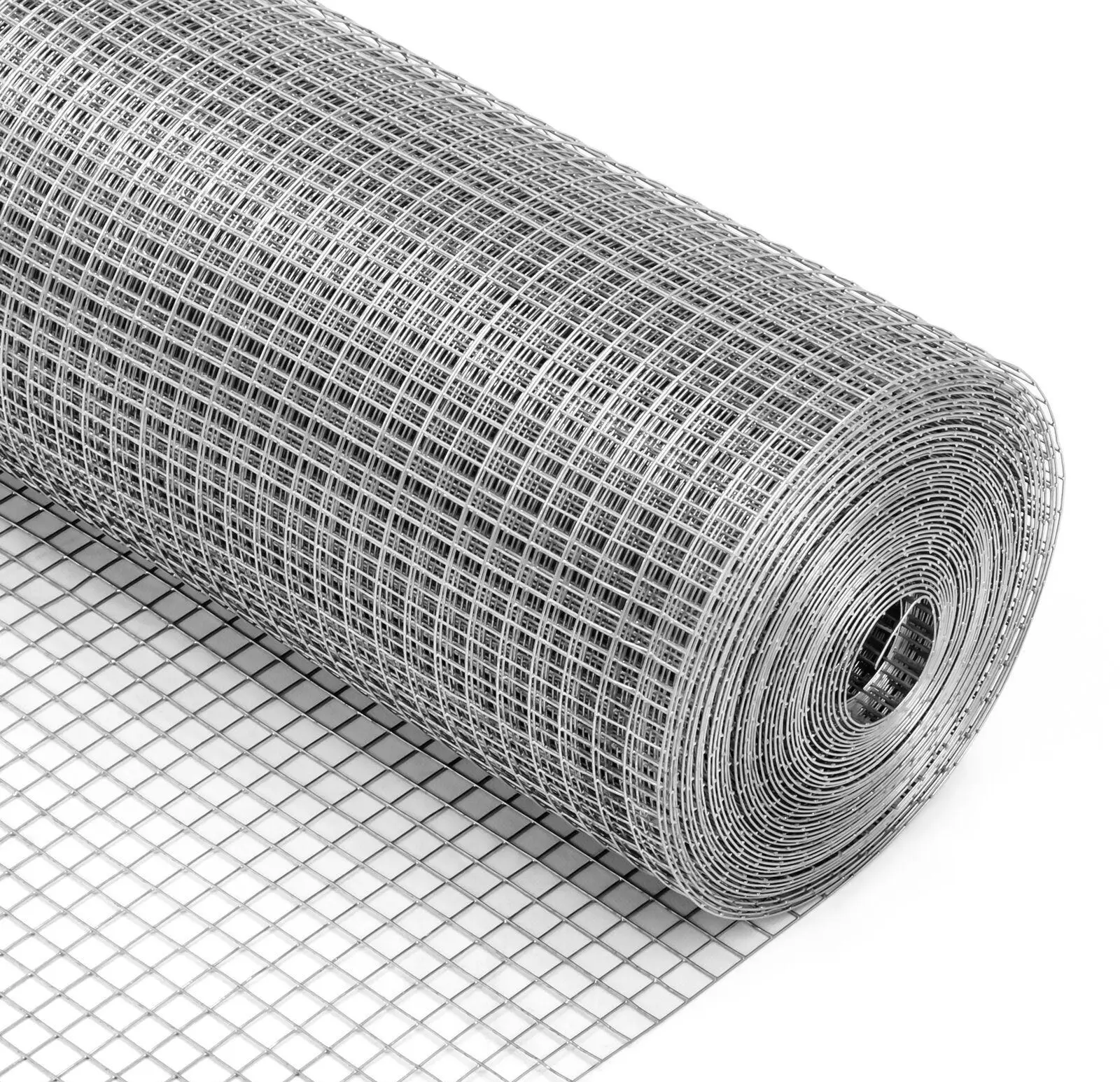

Analyzing Steel Net Prices for Market Trends and Insights

Understanding Steel Net Prices Factors and Implications

The steel industry plays a pivotal role in the global economy, serving as a foundational element for infrastructure development, construction, and various manufacturing processes. The term steel net price refers to the price of steel after accounting for various factors such as discounts, tariffs, and additional costs. Understanding the dynamics behind steel net prices is essential for stakeholders in the industry, including manufacturers, consumers, and investors.

Factors Influencing Steel Net Prices

1. Raw Material Costs The primary components in steel production are iron ore, coal, and scrap metal. Fluctuations in the prices of these raw materials directly impact the cost of producing steel. For instance, a surge in iron ore prices due to increased demand from countries like China can lead to higher steel prices.

2. Production Costs The cost of production is influenced by energy prices, labor costs, and technological advancements. Countries with lower energy costs may have a competitive advantage in steel pricing. Moreover, innovations in steel manufacturing can lead to increased efficiency, potentially lowering net prices over time.

3. Market Demand Global demand for steel is driven by various sectors, including construction, automotive, and consumer goods. During economic booms, demand tends to rise, pushing steel prices higher. Conversely, in times of economic downturns, the demand may fall, leading to lower net prices.

4. Trade Policies Tariffs and trade agreements significantly affect steel pricing on a global scale. For example, the imposition of tariffs on imported steel can lead to higher domestic prices, influencing the overall net price in the market. Conversely, free trade agreements may lower prices by eliminating tariffs, making steel more accessible.

5. Seasonal and Cyclical Trends The steel industry can be subject to seasonal trends, with demand peaking in certain months or quarters. Additionally, it follows cyclical patterns driven by economic conditions. Understanding these trends can help businesses predict pricing and make informed procurement decisions.

Implications of Steel Net Prices

The implications of steel net prices extend beyond simple cost considerations. For businesses, fluctuations in net prices can affect profit margins, leading to changes in pricing strategies for finished goods. For example, manufacturers of construction materials may need to adjust their prices in response to rising steel costs, which can in turn affect the overall cost of building projects.

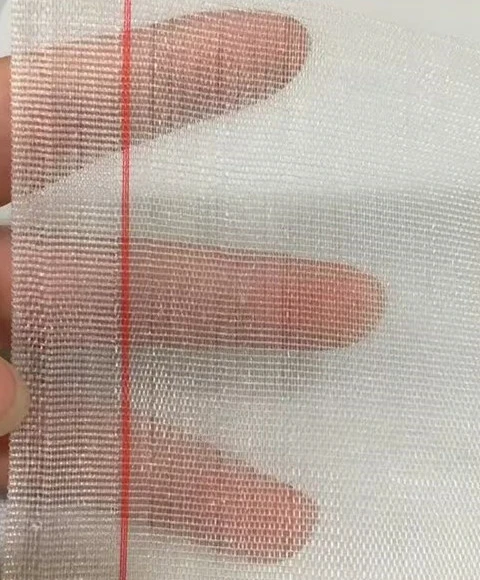

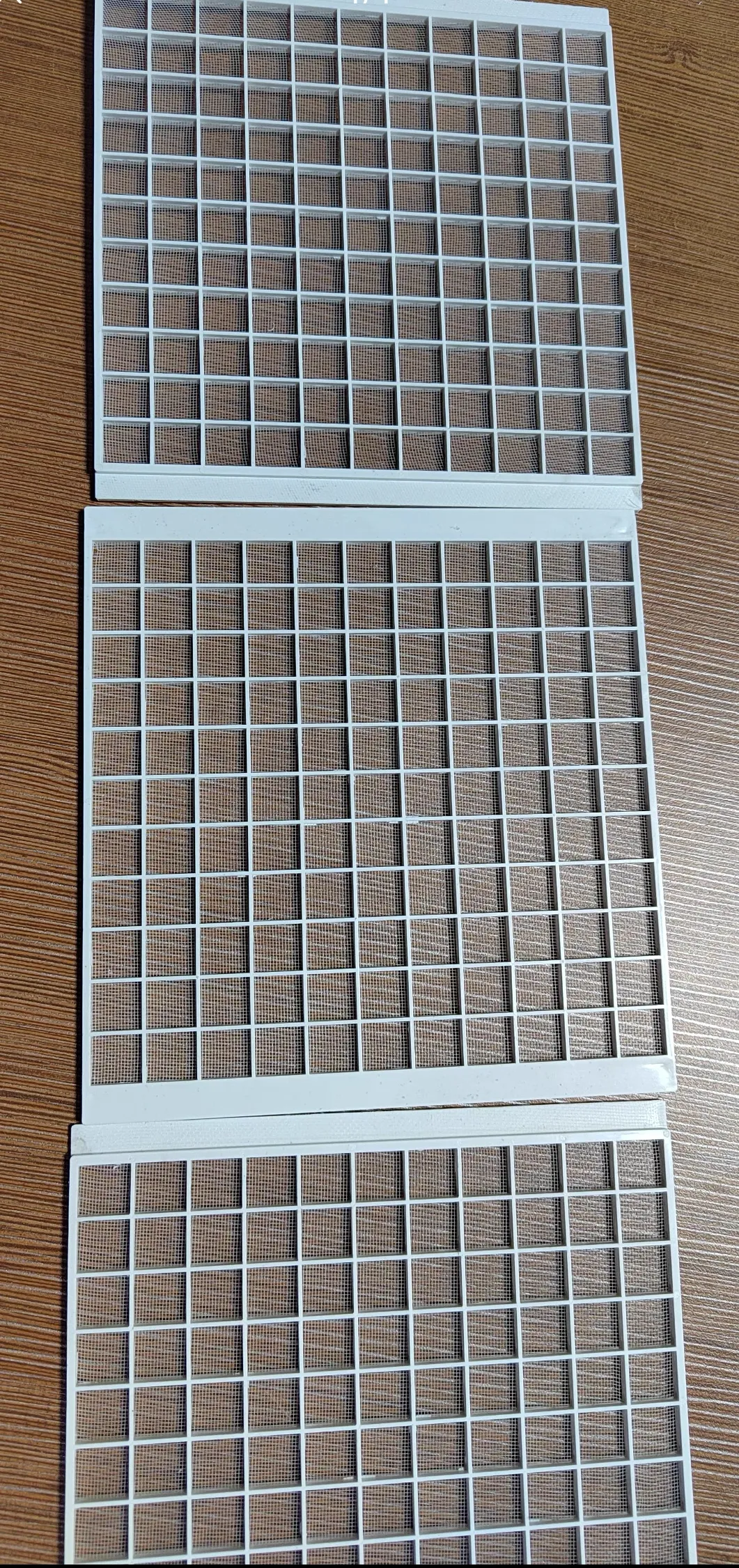

steel net price

Moreover, investors often analyze steel net prices as an indicator of broader economic health. Rising steel prices may signal a booming economy, while declining prices can indicate economic uncertainty. This correlation makes the steel market a critical focus for economic analysts.

Strategies for Managing Steel Costs

Given the volatility of steel prices, businesses can adopt several strategies to manage their exposure

1. Long-Term Contracts Establishing long-term agreements with steel suppliers can help lock in prices and shield companies from sudden market fluctuations.

2. Diversification of Suppliers Relying on multiple suppliers can reduce risks associated with price hikes from a single source. This diversifies procurement strategies and adds flexibility.

3. Inventory Management Maintaining an optimal level of inventory can allow companies to take advantage of lower prices when they arise, while also preparing for potential shortages or price spikes.

4. Investing in Alternatives Exploring alternative materials or innovative practices can reduce dependencies on steel, thereby minimizing risks associated with price volatility.

Conclusion

Steel net prices are influenced by a myriad of factors, from raw material costs to international trade policies. For stakeholders in the industry, understanding these dynamics is crucial for forecasting costs, managing budgets, and making strategic decisions. As the global economy continues to evolve, so too will the landscape of steel pricing, underscoring the need for businesses to remain adaptable and informed. The ability to navigate these complexities will define success in an increasingly competitive market.

-

Shipping Plastic Bags for Every NeedNewsJul.24,2025

-

Safety Netting: Your Shield in ConstructionNewsJul.24,2025

-

Plastic Mesh Netting for Everyday UseNewsJul.24,2025

-

Nylon Netting for Every UseNewsJul.24,2025

-

Mesh Breeder Box for Fish TanksNewsJul.24,2025

-

Expanded Steel Mesh Offers Durable VersatilityNewsJul.24,2025