-

Afrikaans

Afrikaans -

Albanian

Albanian -

Amharic

Amharic -

Arabic

Arabic -

Armenian

Armenian -

Azerbaijani

Azerbaijani -

Basque

Basque -

Belarusian

Belarusian -

Bengali

Bengali -

Bosnian

Bosnian -

Bulgarian

Bulgarian -

Catalan

Catalan -

Cebuano

Cebuano -

China

China -

Corsican

Corsican -

Croatian

Croatian -

Czech

Czech -

Danish

Danish -

Dutch

Dutch -

English

English -

Esperanto

Esperanto -

Estonian

Estonian -

Finnish

Finnish -

French

French -

Frisian

Frisian -

Galician

Galician -

Georgian

Georgian -

German

German -

Greek

Greek -

Gujarati

Gujarati -

Haitian Creole

Haitian Creole -

hausa

hausa -

hawaiian

hawaiian -

Hebrew

Hebrew -

Hindi

Hindi -

Miao

Miao -

Hungarian

Hungarian -

Icelandic

Icelandic -

igbo

igbo -

Indonesian

Indonesian -

irish

irish -

Italian

Italian -

Japanese

Japanese -

Javanese

Javanese -

Kannada

Kannada -

kazakh

kazakh -

Khmer

Khmer -

Rwandese

Rwandese -

Korean

Korean -

Kurdish

Kurdish -

Kyrgyz

Kyrgyz -

Lao

Lao -

Latin

Latin -

Latvian

Latvian -

Lithuanian

Lithuanian -

Luxembourgish

Luxembourgish -

Macedonian

Macedonian -

Malgashi

Malgashi -

Malay

Malay -

Malayalam

Malayalam -

Maltese

Maltese -

Maori

Maori -

Marathi

Marathi -

Mongolian

Mongolian -

Myanmar

Myanmar -

Nepali

Nepali -

Norwegian

Norwegian -

Norwegian

Norwegian -

Occitan

Occitan -

Pashto

Pashto -

Persian

Persian -

Polish

Polish -

Portuguese

Portuguese -

Punjabi

Punjabi -

Romanian

Romanian -

Russian

Russian -

Samoan

Samoan -

Scottish Gaelic

Scottish Gaelic -

Serbian

Serbian -

Sesotho

Sesotho -

Shona

Shona -

Sindhi

Sindhi -

Sinhala

Sinhala -

Slovak

Slovak -

Slovenian

Slovenian -

Somali

Somali -

Spanish

Spanish -

Sundanese

Sundanese -

Swahili

Swahili -

Swedish

Swedish -

Tagalog

Tagalog -

Tajik

Tajik -

Tamil

Tamil -

Tatar

Tatar -

Telugu

Telugu -

Thai

Thai -

Turkish

Turkish -

Turkmen

Turkmen -

Ukrainian

Ukrainian -

Urdu

Urdu -

Uighur

Uighur -

Uzbek

Uzbek -

Vietnamese

Vietnamese -

Welsh

Welsh -

Bantu

Bantu -

Yiddish

Yiddish -

Yoruba

Yoruba -

Zulu

Zulu

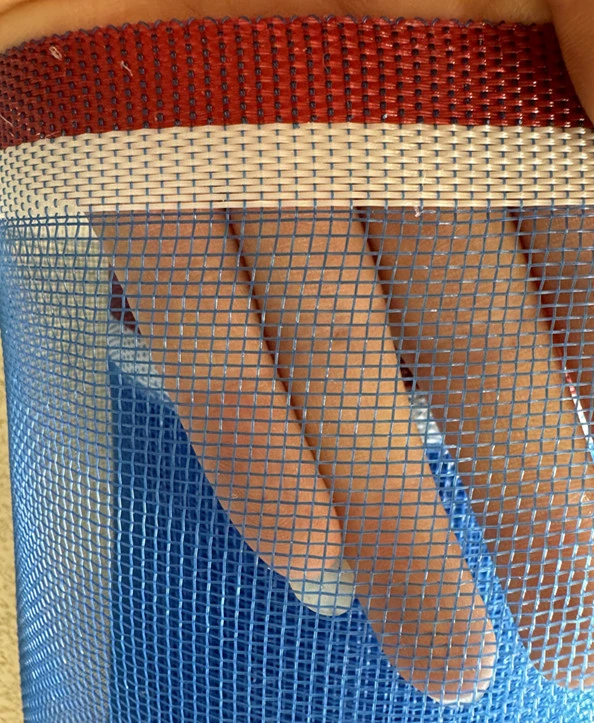

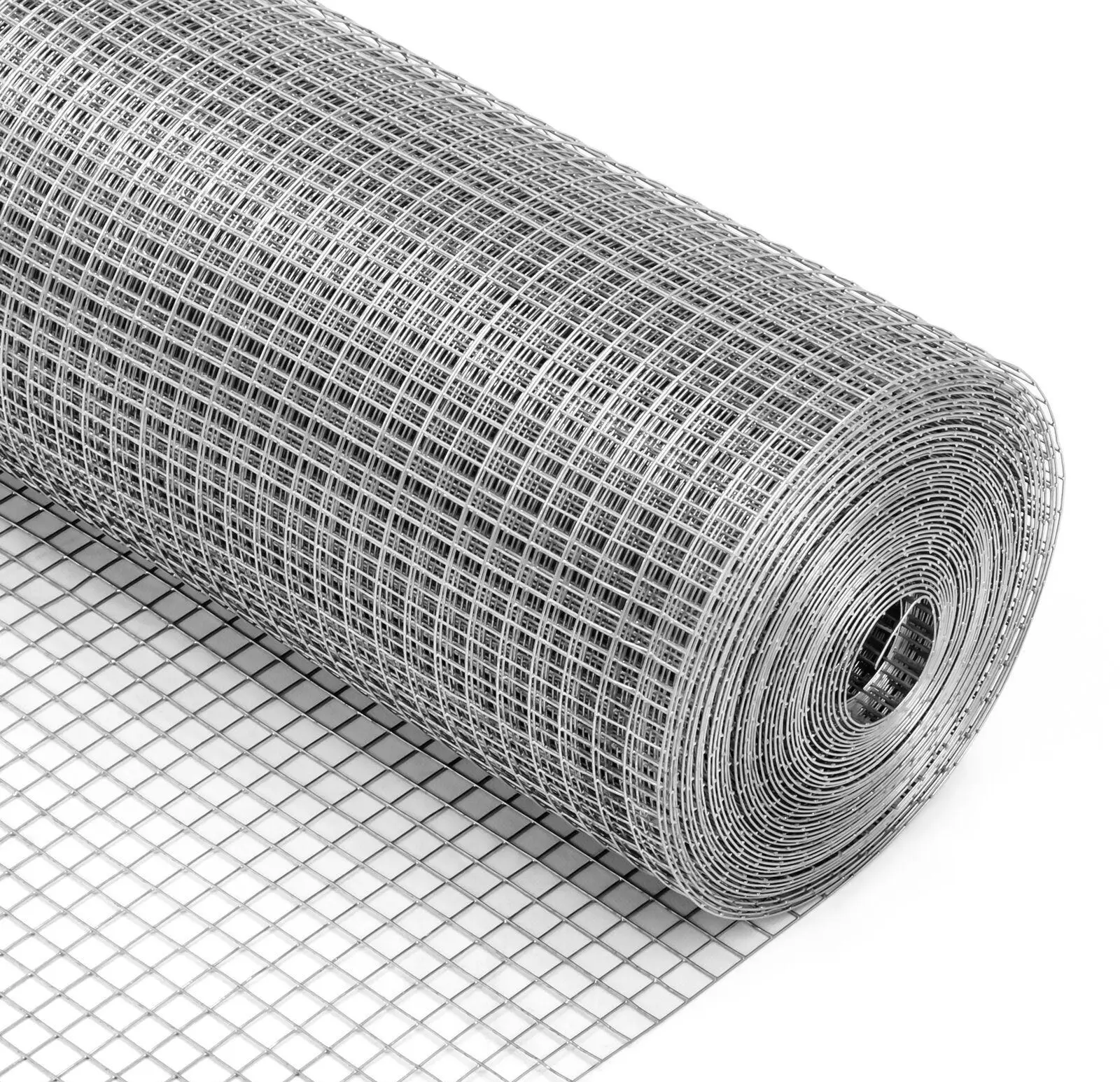

steel net price

Understanding the Dynamics of Steel Net Prices

The steel industry is a crucial component of the global economy, underpinning numerous sectors from construction to automotive manufacturing. As one of the most widely traded commodities, the net prices of steel directly influence production costs and, consequently, market prices for a myriad of finished products. The term steel net price refers to the price of steel after accounting for deductions such as discounts, rebates, and other adjustments. Understanding this price is vital for industry stakeholders, including manufacturers, suppliers, and consumers, as it dictates economic viability and profitability.

Several factors influence the net price of steel, including raw material costs, global demand, trade policies, and technological advancements. The primary raw materials for steel production, iron ore and coal, experience price fluctuations based on global market conditions. For instance, increased demand from major economies, particularly China, often drives up the prices of these inputs, thereby affecting the net price of steel. Conversely, a slowdown in these economies can lead to surpluses and lower prices.

Another significant factor affecting steel net prices is global demand dynamics. Economic growth typically spurs demand for steel, and as construction and manufacturing activity ramps up, so does the need for steel products. Conversely, during economic downturns, demand can wane significantly, leading to declining steel prices. The net price of steel is also impacted by regional demand variations, whereby emerging markets may see spikes in demand compared to more established markets.

steel net price

Trade policies and tariffs can also play a pivotal role in determining steel net prices. Countries often impose tariffs on imported steel to protect domestic industries, affecting the overall supply and price equilibrium. For instance, the United States has historical instances of implementing tariffs on steel imports, which subsequently influenced domestic steel prices and market behaviors. Such policies can create ripple effects throughout the global steel market, impacting net prices worldwide.

Technological innovations in steel production and processing have further shaped the dynamics of steel net pricing. Advances in production efficiencies, recycling methods, and the introduction of alternative materials can lower production costs. These innovations can lead to lower net prices, benefiting consumers and businesses alike. Furthermore, a focus on sustainable practices is emerging within the steel industry, pushing for greener production methods that can create shifts in both costs and pricing structures.

Lastly, geopolitical factors and market speculation can create volatility in steel prices. Events such as conflicts, sanctions, or economic crises can impact supply chains significantly, leading to price fluctuations. Speculation in the commodities markets can compound this volatility, as traders react to perceived changes in supply and demand.

In summary, the net price of steel is a complex interplay of various factors, including raw material costs, demand and supply dynamics, trade policies, technological advancements, and geopolitical influences. For stakeholders within the steel industry, staying informed about these dynamics is crucial to making informed decisions that affect production, pricing, and ultimately, profitability. As the global economy continues to evolve, so too will the nuances of steel pricing, necessitating ongoing analysis and adaptation to market conditions.

-

The Sunshade Net Can Block Ultraviolet RaysNewsAug.11,2025

-

Main Application and Technology of Nylon ScreenNewsAug.11,2025

-

Green Anti UV Sunshade Net: The Perfect Combination of Ecological Friendliness and Practical PerformanceNewsAug.11,2025

-

Explore the Sunshade NetNewsAug.11,2025

-

Application and Development of Nylon Screen in Fuel Processing and TreatmentNewsAug.11,2025

-

Application and Advantages of Nylon Screen for AquacultureNewsAug.11,2025