-

Afrikaans

Afrikaans -

Albanian

Albanian -

Amharic

Amharic -

Arabic

Arabic -

Armenian

Armenian -

Azerbaijani

Azerbaijani -

Basque

Basque -

Belarusian

Belarusian -

Bengali

Bengali -

Bosnian

Bosnian -

Bulgarian

Bulgarian -

Catalan

Catalan -

Cebuano

Cebuano -

China

China -

Corsican

Corsican -

Croatian

Croatian -

Czech

Czech -

Danish

Danish -

Dutch

Dutch -

English

English -

Esperanto

Esperanto -

Estonian

Estonian -

Finnish

Finnish -

French

French -

Frisian

Frisian -

Galician

Galician -

Georgian

Georgian -

German

German -

Greek

Greek -

Gujarati

Gujarati -

Haitian Creole

Haitian Creole -

hausa

hausa -

hawaiian

hawaiian -

Hebrew

Hebrew -

Hindi

Hindi -

Miao

Miao -

Hungarian

Hungarian -

Icelandic

Icelandic -

igbo

igbo -

Indonesian

Indonesian -

irish

irish -

Italian

Italian -

Japanese

Japanese -

Javanese

Javanese -

Kannada

Kannada -

kazakh

kazakh -

Khmer

Khmer -

Rwandese

Rwandese -

Korean

Korean -

Kurdish

Kurdish -

Kyrgyz

Kyrgyz -

Lao

Lao -

Latin

Latin -

Latvian

Latvian -

Lithuanian

Lithuanian -

Luxembourgish

Luxembourgish -

Macedonian

Macedonian -

Malgashi

Malgashi -

Malay

Malay -

Malayalam

Malayalam -

Maltese

Maltese -

Maori

Maori -

Marathi

Marathi -

Mongolian

Mongolian -

Myanmar

Myanmar -

Nepali

Nepali -

Norwegian

Norwegian -

Norwegian

Norwegian -

Occitan

Occitan -

Pashto

Pashto -

Persian

Persian -

Polish

Polish -

Portuguese

Portuguese -

Punjabi

Punjabi -

Romanian

Romanian -

Russian

Russian -

Samoan

Samoan -

Scottish Gaelic

Scottish Gaelic -

Serbian

Serbian -

Sesotho

Sesotho -

Shona

Shona -

Sindhi

Sindhi -

Sinhala

Sinhala -

Slovak

Slovak -

Slovenian

Slovenian -

Somali

Somali -

Spanish

Spanish -

Sundanese

Sundanese -

Swahili

Swahili -

Swedish

Swedish -

Tagalog

Tagalog -

Tajik

Tajik -

Tamil

Tamil -

Tatar

Tatar -

Telugu

Telugu -

Thai

Thai -

Turkish

Turkish -

Turkmen

Turkmen -

Ukrainian

Ukrainian -

Urdu

Urdu -

Uighur

Uighur -

Uzbek

Uzbek -

Vietnamese

Vietnamese -

Welsh

Welsh -

Bantu

Bantu -

Yiddish

Yiddish -

Yoruba

Yoruba -

Zulu

Zulu

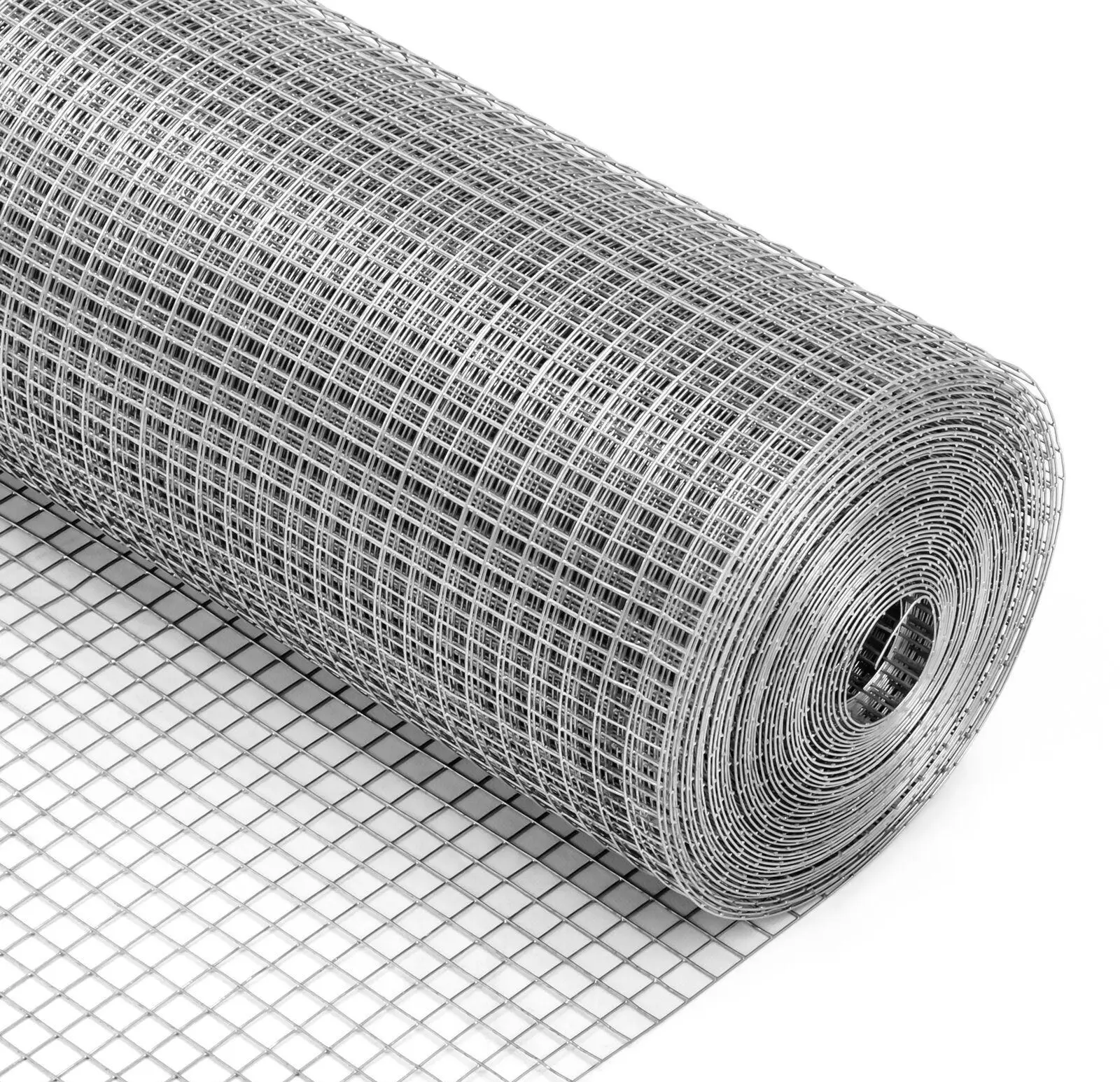

Analyzing Current Trends in Steel Net Pricing and Market Dynamics

Understanding the Dynamics of Steel Net Pricing

The steel industry is a cornerstone of global manufacturing, influencing a wide array of sectors from construction to automotive to delicate electronics. Among the myriad factors that determine the viability and sustainability of this sector, understanding the concept of the steel net price is essential. This term refers to the effective sales price received by steel producers after accounting for discounts, rebates, and other deductions. By delving into the intricacies of steel net pricing, stakeholders can make informed decisions that resonate throughout the supply chain.

The Composition of Steel Pricing

Steel pricing is affected by a multitude of factors including raw material costs, labor expenses, and energy prices. However, one pivotal aspect that directly impacts the net price is market demand and supply dynamics. During periods of booming economic activity, the demand for steel soars, often leading to increased gross prices. Conversely, in economic downturns, demand wanes, which can put downward pressure on prices.

Production costs primarily hinge on the price of iron ore, coal, and limestone, which are essential raw materials in steel making. As the costs of these inputs fluctuate, they directly influence the gross price of steel. Notably, while producers strive to pass on rising costs to consumers, the market’s competitive landscape may hinder their ability to do so fully.

Discounts and Deductions

Once the gross price is established, various discounts and other adjustments come into play to arrive at the net price. These can include volume discounts, contractual rebates, and promotional offers aimed at attracting new customers or retaining existing ones. For instance, buyers that purchase in bulk often negotiate lower prices per ton, which directly impacts the steel producer's net pricing.

Additionally, industry-specific market practices can significantly alter how net prices are calculated. In many cases, steel manufacturers engage in long-term contracts with buyers, which can include price adjustment clauses tied to fluctuating market indices. Understanding the nuances of these agreements can illuminate why net prices might differ even among similar products from various manufacturers.

steel net price

The Global Influence of Trade Policies

The steel market is not merely a reflection of domestic economics but is also intertwined with global dynamics. Trade policies, tariffs, and quotas imposed by governments can dramatically alter the competitive landscape. For instance, tariffs on imported steel can lead to increased domestic prices, thereby affecting the net pricing strategy of local producers. Additionally, anti-dumping measures and trade agreements can help stabilize or destabilize prices based on international market conditions.

Environmental regulations also play a crucial role in shaping production costs and, consequently, the net price. As the world turns towards more sustainable practices, the investments necessary to reduce emissions or switch to greener technologies can significantly impact the final price tag on steel products.

The Importance of Transparent Pricing

For buyers and sellers alike, clarity in steel net pricing offers significant advantages. Transparent pricing allows customers to accurately assess the cost of procurement, enabling better budgeting and forecasting. Conversely, steel producers benefit from clear pricing strategies that can enhance customer trust and lead to long-term business relationships.

Moreover, technological advancements such as artificial intelligence and big data analytics are increasingly being employed to forecast pricing trends and optimize pricing strategies. By leveraging such tools, steel producers can adjust their pricing dynamically based on real-time data related to market conditions, thus refining their net pricing approach.

Conclusion

In summary, steel net pricing is a complex interplay of various factors ranging from raw material costs to market dynamics, global trade influences, and production practices. Understanding these elements is crucial for stakeholders in the industry. As the steel market continues to evolve, maintaining clarity and adaptability in pricing strategies will be fundamental for producers and customers alike. The ability to navigate the nuances of steel net prices not only supports business viability but also contributes to the broader health of the global manufacturing ecosystem. As we forge ahead, the importance of effective pricing strategies will remain pivotal in shaping the future of the steel industry.

-

The Sunshade Net Can Block Ultraviolet RaysNewsAug.11,2025

-

Main Application and Technology of Nylon ScreenNewsAug.11,2025

-

Green Anti UV Sunshade Net: The Perfect Combination of Ecological Friendliness and Practical PerformanceNewsAug.11,2025

-

Explore the Sunshade NetNewsAug.11,2025

-

Application and Development of Nylon Screen in Fuel Processing and TreatmentNewsAug.11,2025

-

Application and Advantages of Nylon Screen for AquacultureNewsAug.11,2025